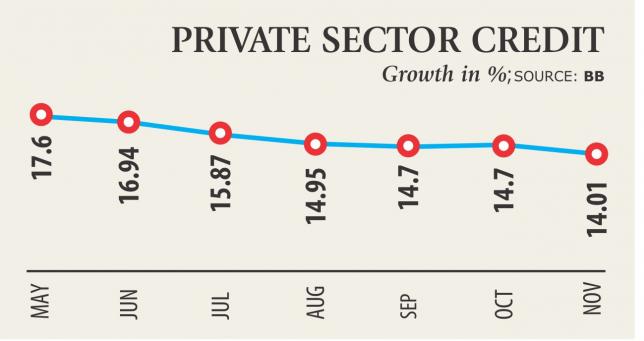

Private sector credit growth hits 3-year low

Private sector credit growth hit a three-year low in November due to cautious lending and reluctance by businesses to go for expansion ahead of the polls, which took place on December 30.

In November, credit growth stood at 14 percent year-on-year, down from 14.7 percent in the previous month, according to data from Bangladesh Bank.

The credit growth is far below the ceiling of 16.8 percent set by the BB for the second half of 2018.

The central bank is likely to keep the private sector credit growth target unchanged at 16.8 percent in its latest monetary policy, which will be announced later in January, said a senior BB official.

Private sector credit growth remained slow due to lack of demand from businesses amid uncertainty ahead of national election, said Syed Mahbubur Rahman, managing director of Dhaka Bank.

Moreover, banks emphasised on recovery towards the end of the year instead of disbursing loans.

The demand for credit is set to escalate in the New Year, after the general elections, said Rahman, also the chairman of the Association of Bankers, Bangladesh, a platform of banks' managing directors and chief executives.

Liquidity shortage is also responsible for the slow private sector credit growth, said a senior executive of another private bank.

The cut in cash reserve ratio in April had increased the flow of money in the banking system for a couple of months, but the effect did not last long, he said.

Some banks are offering interest rates of more than 10 percent for deposits due to fund crisis, he added.

The BB apprehends the uptick in credit growth after the election will increase the inflationary pressure.

“The central bank will check aggressive lending by keeping the credit growth ceiling unchanged,” the BB official said.

Public sector credit growth, which was in the negative in recent months, stood at 7.80 percent in November thanks to heavy borrowing by the government ahead of the polls.

However, the growth rate is still below the monetary ceiling of 15.9 percent set for the second half of 2018.