Private sector credit growth accumulates in May - on paper

Private sector credit data appears to have gone against the grain in-may.

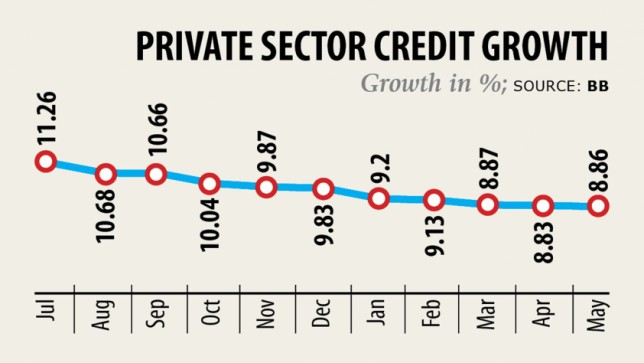

For two years on the trot, private sector credit growth was lesser than in the last month. And the pattern was expected to continue given the entire doom and gloom on the economy.

But in May, it edged up to 8.86 per cent from 8.83 % a month earlier, according to data from the central bank.

"This is not the turnaround that people are desperately looking forward to," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

In May, monetary activities started on a restricted scale and both central bank and the federal government began release a funds from the stimulus packages for businesses.

For instance, garment factory owners took out funds from the Tk 5,000 crore package allotted from their website to provide the salaries of their employees, he said.

Banks had started disbursing loans and opening and settling the letters of credit on a restricted scale since May, which also helped force the credit expansion, said MA Halim Chowdhury, managing director of Pubali Bank.

"We should have the problem into account while deciding the private sector credit growth figure in-may," said Mansur, a previous economist of the International Monetary Fund.

The credit growth increase in the real sense once the country gets rest from the pandemic following the vaccine for COVID-19 is invented.

Another reason behind the uptick may be the banks' deciding on interest capitalisation on response to the central bank order to not classify any types of loan until September with the view to cushioning the blow for borrowers from the ongoing financial mayhem, said Mansur, also the chairman of Brac Bank.

Interest capitalisation is the addition of unpaid interest to the main balance of financing. The next interests are calculated upon this new volume, meaning the loan balance increases as time passes and borrower eventually ends up with a more substantial loan amount.

Syed Mahbubur Rahman, controlling director of Mutual Trust Bank, echoed the same as Mansur about the result of interest capitalisation in May's credit growth amount.

Although banks traditionally calculate the interest capitalisation towards the end of every quarter, many lenders have perhaps adopted the technique in the center of the quarter given the ongoing terrible situation.

"The stimulus packages and credit relaxation on borrowers will be great in the interest of keeping the wheel of the economy moving. But this time the increased credit progress will not contribute to the economy," explained Rahman, also a previous chairman of the Association of Bankers, Bangladesh, a forum of managing directors of banks.

In fact, presented the government's increasing tendency to borrow from the banking sector, the private sector may be crowded out from funds altogether.

The undetermined state of the coronavirus epidemic curve in Bangladesh also suggests that economic activities cannot commence in earnest anytime soon. So, May's figure appears such as a blip in the narrative of private sector credit rating growth rather than a harbinger.