Pharma winning global markets

Pharmaceuticals export has crossed $100-million mark for the first time in the country's history, according to the Export Promotion Bureau.

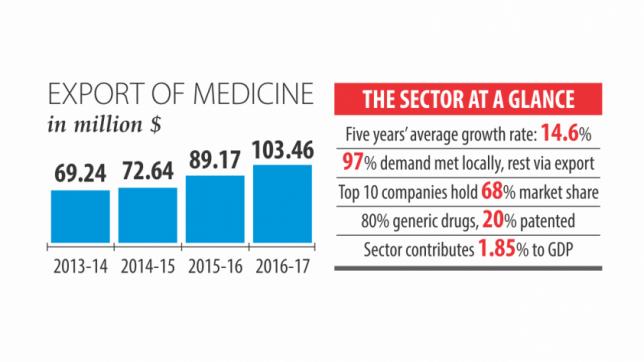

Export earnings from the sector hit $103.46 million in 2017-18, up 16.03 percent from a year ago thanks to improved compliance by the local manufacturers.

Shipment of pharmaceutical products registered an average 14.6 percent growth between 2011 and 2016.

“Pharmaceutical companies have the potential to earn $1 billion a year through exports in the next five years, but the sector needs fiscal benefits and policy support to do so,” Abdul Muktadir, managing director of Incepta Pharmaceuticals, told The Daily Star recently.

“Domestic demand is also growing,” he said.

Local players dominate Bangladesh's pharmaceutical industry. Square Pharmaceuticals is the major player with 18.8 percent share. Incepta holds 10.2 percent share, Beximco 8.5 percent, Opsonin 5.6 percent, Renata 5.1 percent and Eskayef 4.5 percent, according to the Bangladesh Association of Pharmaceuticals Industries.

Multinational companies Radiant, Sanofi and Novo Nordisk also have significant presence and are focused on some specialised products.

Bangladesh exports pharma products to 144 countries and caters 97 percent of the domestic need. Per capita consumption of medicine in Bangladesh was about $15.36 in 2017.

In 2012, the local market size stood at Tk 9,390.4 crore and rose to Tk 18,755.6 crore in 2017, according to IMS Health Care Report 2017.

Currently, Bangladesh has the ability to produce advanced medicines such as bio-similar drugs, vaccines and oncology products as well as medical devices.

The country has a surplus of pharmaceutical industry-focused human resources, Muktadir said, adding that the formulation industry is well-developed and investing heavily for future growth.

Mizanur Rahman Sinha, managing director of ACME Laboratories Ltd, said the export figure is insignificant but the sector has a good future in the foreign market.

“A number of foreign buyers come and visit our factories and examine the quality of products. They place order when they find that the products are of good quality,” he said.

He said the export volume will go up gradually as the quality of products is improving day by day.

Sinha said the exports will also increase if Indian and Chinese companies invest in Bangladesh in joint ventures with local companies and bring technology.

Local consumption of medicine is increasing in line with the rise of people's purchasing capacity, he said.

Mohammad Ebadul Karim, managing director of Beacon Pharmaceuticals, emphasised on upgrading technology to boost exports and enter regulated markets.

Since the beginning of the decade, the pharmaceutical industry has experienced double-digit growth driven by a large consumer base, improved health consciousness and a supportive regulatory framework.

Two effective policies have accelerated the growth of the sector. One was the Drug Control Ordinance 1982, which banned foreign companies from selling imported pharmaceutical products in the country last year, according to a research of LR Global, an asset management firm. The other was the relaxation of the World Trade Organisation's agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), which permitted Bangladesh to reverse engineer patented generic drugs.

The relaxation of TRIPS for least developed countries has been extended to 2032.

Bangladesh can significantly boost its pharmaceuticals exports on the back of the patent waiver as it is the only LDC that produces pharmaceuticals, according to the National API and Laboratory Reagents Manufacturing and Exports Policy.

In 2015, the US Food and Drug Administration gave approval to Square Pharmaceuticals and Beximco Pharmaceu-ticals after inspecting the oral solid dosage facilities of the two companies.

At present, oncology drugs are imported but some of the local players like Renata, Beacon and Acme have heavily invested in the segment.

Although the sector has grown fast, the country largely relies on imports for raw materials in the absence of local active pharmaceuticals ingredients (API): about 95 percent of the Tk 5,000 crore worth of raw materials needed by the pharmaceutical sector are brought in from abroad.

This had led the government to come up with the policy, which offers a host of incentives to encourage local manufacturing of raw materials for the pharmaceutical sector.