Only one 1 in 1,960 small companies got soft loans from govt’s revamp funds

Only a single firm out of just one 1,960 pandemic-hit cottage, micro and small enterprises mainly in the light engineering sector has received the soft loan from the stimulus package, according to a report.

The disclosure painted a bleak picture because they suffered the most because of the coronavirus pandemic. Simultaneously, they might also be at the front end during the recovery process.

In order to permit them to make a comeback, the government has announced a Tk 20,000-crore stimulus package for the CMSME sector.

However, almost all of the enterprises cannot avail the amount of money from the fund due to stringent conditions, too little information, too little cooperation from banks and small portfolios of the enterprises, according to the study by the Brac Institute of Governance and Development (BIGD).

The study discovered that 1,226, or 63 % out of just one 1,960 surveyed enterprises know about the stimulus package. Three % of the enterprises requested the support. But 1,000, or 54 per cent of the firms have no idea how to apply.

The rapid response research based on telephone interviews styled "The effects of Covid-19 on small firms: evidence from large-scale surveys of owners and employees" was conducted by Asad Islam, an economics professor at the Monash University, and Atiya Rahman, a senior research associate at the BIGD.

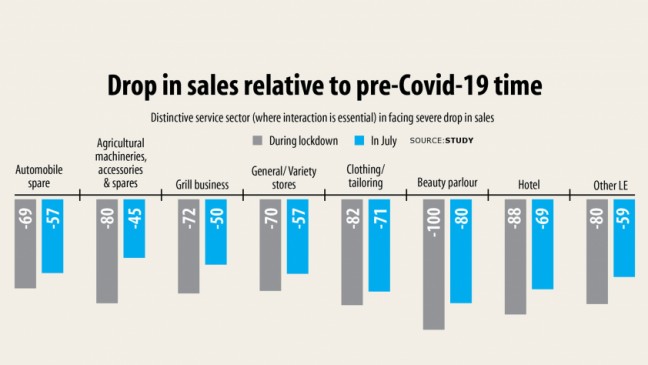

The participants, which included enterprises involved in creating automobile spares, agriculture machinery, accessories and also general stores, hotels, beauty parlours and tailors, were interviewed between July 14 and July 23.

The researchers presented the findings at a virtual meeting yesterday.

The survey found 60.71 % of the enterprises were open in July while 69.13 % were closed through the lockdown, which commenced on March 26 and continued until May 31 prior to the gradual lifting of restrictions from June.

Poor owners are less inclined to operate their business at full capacity, the survey found.

In July, 21.96 per cent owners were not able to clear workshop rent in the past one month and 15.87 per cent through the lockdown period as a result of a drop in sales, way higher than 1.82 % before the Covid-19.

Some 13.37 % enterprises in July and 7.6 % during the lockdown cannot pay utility bills. It had been 1.12 % prior to the lockdown was enforced.

Some 98.01 % of personnel worked for fewer hours or got payed for fewer hours through the lockdown. It was 81.32 per cent in July.

A fourth of the personnel were laid off through the lockdown and 11.29 per cent in July, according to the survey.

The study found female workers are in a greater risk as a result of the limited usage of formal financial support no usage of the government's support package.

"Female personnel are losing jobs and so are less likely to return to work following the lockdown," it said.

Three-fourth of the enterprise owners are highly worried about the continuing future of their business and 46.33 % have no idea how long it could take before they can resume full operation.

Forty-seven per cent of the enterprises have access to loan or grants to support business recovery while one-fourth enterprises haven't any access to loan no plan for business recovery.

"Enterprises are struggling to produce a profit following the lockdown," it said.

While moderating the discussion, Imran Matin, executive director of the BIGD, said the recovery of the enterprises from the fallouts of the Covid-19 continues to be fragile and lower-end enterprises remain struggling a lot.

"The composition of the recovery is unequal," he said.

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, said a good number of enterprises are not interested to take loans from the stimulus package because they feel that they would face a whole lot of trouble if they cannot repay.

The CMSME sector represents 13 million business entities in Bangladesh, contributing 25 per cent to the GDP, 35.5 per cent to total employment and 80 % to export earnings, based on the Dhaka Chamber of Commerce and Industry.