Most NBFIs see a rise in profits

Almost all of the listed non-bank financial institutions (NBFIs) posted higher profits in the July-September quarter because of the low provisioning regime amid the ongoing pandemic.

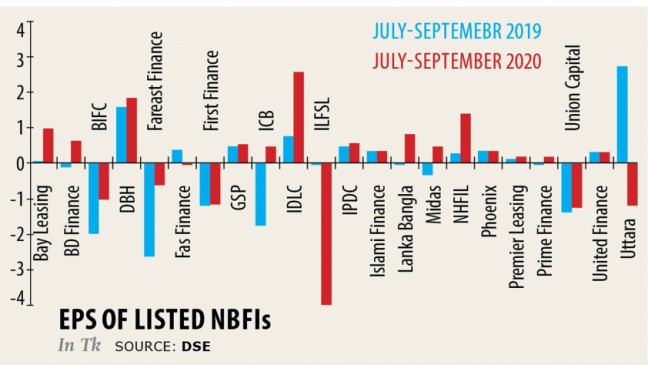

All but Peoples Leasing out of the 23 listed NBFIs published their financial reports. Of these, the earnings of 10 rose year-on-year, and four bounced back and returned to profits.

The earnings of 1 NBFI remained the same, while the rest seven experienced a fall in the current year's third quarter.

IDLC Finance booked higher earnings per share, followed by DBH and National Housing Finance.

BD Finance, the Investment Corporation of Bangladesh, LankaBangla, and Midas Financing returned to the black after incurring a loss in the same quarter last year.

Uttara Finance and International Leasing Financial services drowned into losses in the quarter.

Despite posting higher profits, investors remain feeling shaky to purchase the stocks of the NBFIs as they fear bad times are coming next year.

"The NBFIs' margin rose on the trunk of lower deposit rates," said Arif Khan, managing director of IDLC Finance.

"When the deposit rate falls, banks and NBFIs get its benefits because their interest cost falls instantly. Their interest income drops slowly."

Many loans carry a set interest, and the loan contracts are created for 3 to 4 years. So, these loans bear higher earnings despite the fast fall of interest on deposit, he clarified.

The federal government set the ceiling on banks' lending rate at 9 %, and the deposit rate at 6 per cent with regard to industrialisation and the rates came into influence on April 1 this year.

Many NBFIs reduced their operating costs through the pandemic, which gave a boost with their profits, Khan said.

As the currency markets was on an upward trend, many NBFIs booked profits this season whereas they had a need to keep provision for the losses made in the prior year, Khan said.

The brokerage income of IDLC Finance also rose within the last quarter, he said.

The DSEX, the benchmark index of the Dhaka STOCK MARKET, rose 28 per cent, or 1,130 points, in the July-September period. It dropped 8.1 %, or 436 points, in the same period this past year.

The Bangladesh Bank allowed banks and NBFIs to restructure loans and keep classification unchanged until December to greatly help entrepreneurs stay afloat amid the pandemic, which eventually helped the NBFIs see the rise in profits, Khan said.

"It was a timely decision taken by the banking watchdog for the reason that pandemic year isn't comparable to the standard time. It was necessary to give the potential for restructuring loans to greatly help the economy revive."

The NBFIs whose business was in good shape and whose business was in bad form would be evident next year, he said.

The NBFIs will fall into problem next year as they will be bound to classify bad loans, said Abdul Mannan, a stock investor.

Because this isn't the true scenario of the sector and most of the entrepreneurs who failed to continue steadily to pay their loans now can be defaulter next year, he said.

Moreover, the rising non-performing loans (NPLs) are also a major headache for the NBFIs.

The NPLs in 33 NBFIs in Bangladesh, like the listed ones, stood at Tk 8,905.62 crore by June this year, which were 13.29 per cent of the outstanding loans, according to data from the Bangladesh Bank. It was Tk 6,399 crore, or 9.53 per cent of the full total loans, in December last year.

Of the listed NBFIs, the stocks of nine traded below their face value on the DSE on November 12.