Mighty taka puts Bangladesh Bank in a bind

For exporters desperately trying to maintain the most recent robust run of merchandise sales abroad and cement the recovery from the coronavirus pandemic, an old problem has raised its head: a rising taka against a falling US dollar.

The problem has prompted the authorities to call on the central bank and the federal government to take initiatives to shield exporters from the appreciating trend of the local currency.

Although the export volume has increased in recent months defying the uncertainty stemming from the ongoing economical slowdown, exporters are still facing hurdles as a result of relatively higher exchange rate of the taka against its peers.

Within its efforts to prevent the appreciation of the taka, the central bank has started purchasing the dollar from banks immediately after the recession hit the united states.

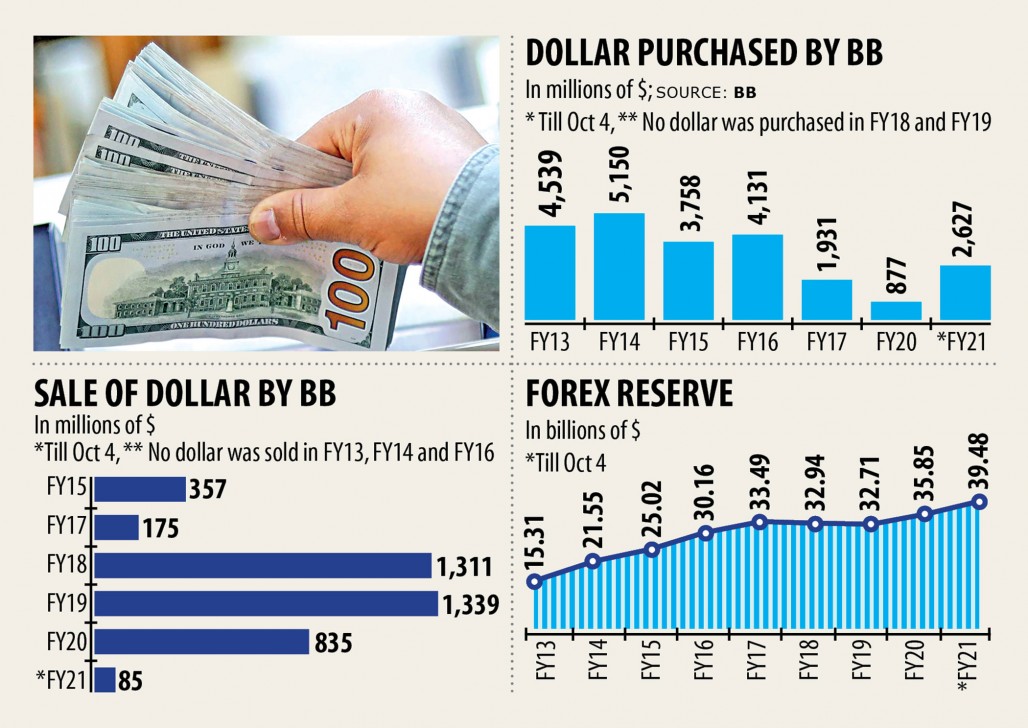

Between July 1 and October 4, the Bangladesh Bank bought the dollar worth $2.62 billion, up 200 per cent from the last fiscal year.

Still, the interbank exchange rate fell slightly to Tk 84.80 per US dollar as opposed to Tk 84.95 on March 25, a day before the country declared the countrywide lockdown to support the coronavirus pandemic.

The central bank, however, has managed a bit of success in stemming the massive appreciation of the local currency by intervening in market.

The inter-bank exchange rate has been hovering between at Tk 84.80 and Tk 84.90 since July.

Had the central bank not intervened in market, the local currency could have risen to an excellent extent. But this is simply not good enough given the exchange rate far away.

For example, the Indian rupee was at 73.26 per dollar on October 5, up from 71.37 on January 1, according to data from the Reserve Bank of India.

"The Bangladesh Bank will face a challenge to depreciate the neighborhood currency in the next couple of months given the ongoing global financial situation," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Export earnings have been on the rise in recent months, but the country must keep up with the trend in the times ahead to keep carefully the wheels of the economy moving, he said.

In the first three months of the ongoing fiscal year, export earnings returned to the black as apparel shipments grew 2.58 per cent year-on-year to $9.89 billion.

Also, the government has received adequate fund in the kind of soft loans and grants from various multilateral lenders to tackle the monetary slowdown amid a fall in earnings collection and rising expenditure.

These have given a boost to the forex reserve: it stood at $39.48 billion on October 4 as opposed to $33.09 billion on May 5.

"Although the financial indicators are magnificent, these have indicated the weakness of the economy in the wake of an abrupt drastic fall in domestic consumption," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

THE UNITED STATES dollar faced a 6 per cent drop on a trade-weighted basis since April because of the ogoing recession, according to a report of the Financial Times on September 28.

It is widely expected that the dollar may depreciate around 15 to 20 % against a basket of its peers in the next five years.

The dollar index can be used to measure the value of the greenback against a basket of six world currencies - Euro, Swiss Franc, Japanese Yen, Canadian dollar, British pound, and Swedish Krona.

"The BB could offer a cash incentive to all or any exporters for the time being as halting the depreciation of the dollar isn't possible for enough time being," said Rahman.

"Our exporters are receiving lower earnings than what the businesses of the competitive nations are enjoying because of their lower exchange rate against the dollar," he said.

Exporters have been facing the same problem even prior to the coronavirus pandemic struck Bangladesh.

Emranul Huq, managing director of Dhaka Bank, said banks are enjoying satisfactory foreign exchange liquidity due to a continuous upsurge in remittance and export.

Between July and September, remittance earnings hit $6.71 billion, up 48.52 % year-on-year.

But buyers will feel discouraged to buy the country's goods if the taka continues to keep an increased exchange rate.

The central bank may cut the interest rate on its Export Development Fund further to ensure that exporters can borrow at a lower cost, Huq said.

"This will help trade off losing for exporters emanating from the overvalued local currency," he added.

The central bank has injected reserve money to the tune of Tk 60,000 crore in to the market against the ballooning forex reserve, said Mansur.

Reserve money can be called as high-powered money, base money and central bank money.

Each one of these names suggested that the reserve money represents the base level for the money supply or it's the high-powered component of the money supply.

The initiative of the central bank, which now supplies money regularly, has helped the banking sector through the ongoing recession since it made more funds available for the lenders.

The forex reserve may shoot to $45 billion within the next six months since it will take more time for the imports to pick up amid declining domestic consumption, Mansur said.

But such injection of the reserve money ought to be stopped when domestic consumption rebounds.

If required, the central bank even should mop up the surplus money from the banking sector after a certain period to include a probable inflationary pressure.

"You will have no scope for an inflationary pressure for at least another six months given the ongoing situations," said Mansur, also a former senior official of the International Monetary Fund.