MFS transactions hit all-time saturated in July

Transactions through mobile financial services hit an all-time high of Tk 62,999 crore in July as an increasing number of people, businesses and government agencies are turning to the channel to avail digital services to keep carefully the deadly coronavirus away.

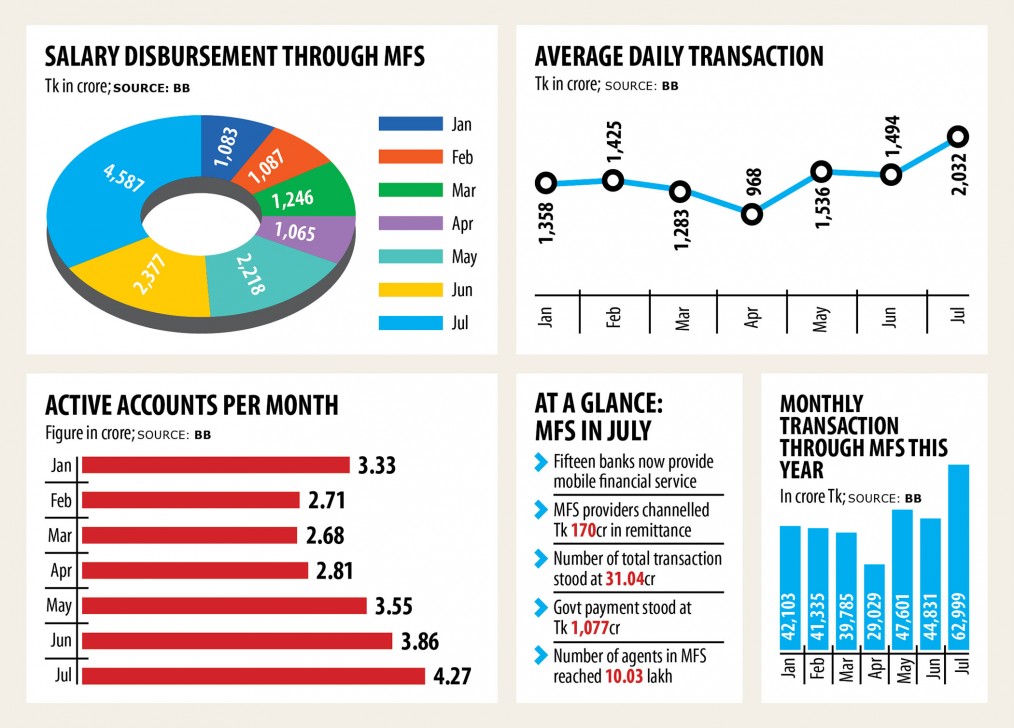

July's figures are 40.5 % higher than that a month earlier and 68 % greater than recorded in the same month a year ago, according to data from the central bank.

This was the very first time that monthly transactions through the country's 15 MFS providers have gone past Tk 50,000 crore because the country introduced the MFS practically a decade ago. The prior highest of Tk 47,601 crore was posted in-may.

"That is a reflection of the collective efforts set up by both MFS providers and the regulator," said Kamal Quadir, chief executive officer of bKash, the country's major MFS provider with regards to transaction and number of accounts.

"The magnificent transaction record in addition has indicated that the economy is slowly but surely recovering from the financial meltdown that is storming the complete globe for a couple months," he said.

The amount of active accounts rose 27.46 per cent year-on-year to 4.27 crore in July as persons choose the digital financial tool as part of your before to accomplish banking from home.

The daily average transaction was up 36 per cent to Tk 2,032.24 crore in July in comparison to June and the amount of total transactions in the month went up by 21.2 % in per month to 310,442,380, BB data showed.

People are preferring digital financial platforms for daily spending which has given a boost to July's transaction, said Tanvir Ahmed Mishuk, managing director of Nagad, the country's fastest-growing MFS provider.

"Consumers are getting familiar with buying products through the contactless transaction," he said, adding that the Covid-19 has played an important role in pushing shoppers towards the digital platform.

Digital financial inclusion was a development priority prior to the Covid-19 emergency; now it really is indispensable for both short-term relief and as a central element of the broad-based, sustainable recovery effort, according to a World Bank paper.

Access to technology may be the foundation of digital financial service (DFS) and this starts with usage of key digital tools such as for example cell phones for consumers and digitisation of business processes for small and medium enterprises, the paper said.

And the central bank's data showed that Bangladesh is on the right track in its fight against the financial recession by embracing DFS.

Both government and the central bank have out emphasis on the DFS just after the united states had plunged in to the monetary hardship in March.

Many garment industries disbursed wages and salaries beforehand and festival bonus for Eid-ul-Azha, among the greatest religious festivals for Muslims that was held on August 1, putting a positive effect on the transaction, Quadir said.

"A good number of folks avoided travelling to celebrate the festival to avoid coronavirus. But they sent money with their near and dear kinds through the MFS channel," he said.

Salary disbursement from businesses to people advanced 93 % to Tk 4,586.97 crore in July in comparison to a month ago.

Government payment through MFS stood at Tk 1,076 crore in July, up 200 per cent in one month earlier and 158 % year-on-year, riding on the social protection payments made through the digital channel.

"Transactions through MFS increase more in the times ahead as persons now emphasise branchless banking," said Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank, which owns Rocket, another MFS provider.

"The module of the DFS will spur the economic growth as well," he said.

The digitalisation of smaller businesses strengthens productivity and increases their usage of finance and markets, the WB paper said.

It also quoted a study conducted by International Data Corporation covering a lot more than 3,200 SME CEOs from 11 different countries. The analysis found that 49 % of the CEOs think that technology levels the playing field for smaller businesses versus larger corporations.

From a macroeconomic perspective, the digitalisation of SMEs may also enhance a country's financial activity, the WB paper said.

Generally in most countries, digital payments services are evolving into digital lending, as companies accumulate users' data and develop new methods to utilize it for creditworthiness analysis, according to articles of the International Monetary Fund.

In Bangladesh, BKash and City Bank have previously taken a joint effort to disburse loans with their clients utilizing the MFS tool.

A select group of bKash users can get collateral-free loans as high as Tk 10,000.

Because of the digital lending model, loan-seekers no more need to go through a physical process to avail financing. The whole process is done digitally and paperless and the service delivery is cashless and all this is done in a couple of minutes.

City Bank and bKash inked an agreement on July 21 to supply the service on a pilot basis. Upon successful completion of the trial run, the merchandise would be rolled from a wider scale.

The collateral-free, instant digital loan may bring transformative impact among marginalised people, micro-entrepreneurs and students to meet up their emergency personal or business needs.

The amount of MFS agents crossed 10 lakh to stand at 1,003,005 at the end of July.

Digital financial inclusion is also connected with higher GDP growth, the IMF article said.

Through the Covid-19 lockdowns, digital financial services are enabling governments to supply quick and secure financial support to "hard-to-reach" persons and businesses.

"This can help mitigate the monetary fallout and potentially strengthen the recovery."