Lifting private investment will be a tall order

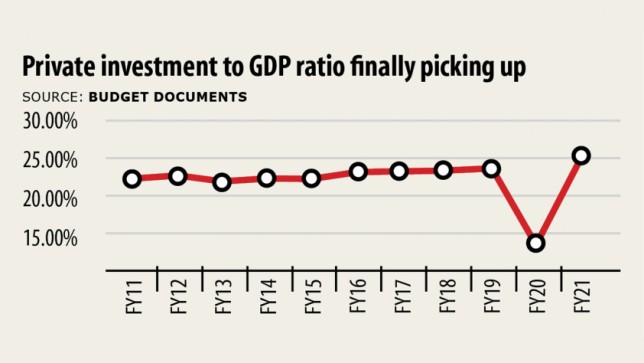

The government is aiming to lift private investment to GDP ratio to a record 25.3 per cent this fiscal year although the coronavirus-induced uncertainty showed no signs of abating and structural challenges are largely unaddressed.

The ratio is merely doubling of the revised private investment-to-GDP ratio of 12.72 % in the just-concluded fiscal year.

In the wake of the devastating coronavirus pandemic, the federal government was compelled to revise down the private investment target, from 24.2 per cent, as the economy came to a screeching halt, rendering factories, industries and offices closed.

The target is only a percentage point greater than the actual private investment ratio last fiscal year.

But individual investment's historical trend even during normal times as well didn't show much hope: it's been ranging between 22 and 24 % for greater than a decade.

The Bangladesh Bureau of Statistics hasn't published some of the private investment figure going back fiscal year. Even so, everything would depend on where in fact the coronavirus rampage hits the brakes.

The infections from the deadly pathogen are growing swiftly in Bangladesh and several elements of the world. Some 2,275 people tested positive for COVID-19 within the last 24 hours, explained the Directorate General of Health Offerings yesterday. Some 54 persons died, taking the full total death toll to 2,928.

"I guess neither the general public investment target nor the private investment target will be achieved in the current fiscal year," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Revenue earnings possess plummeted due to the pandemic, which is compelling the government to choose slashing expenditure.

Because of this, public investment will be lower than the mark.

Simultaneously, there won't be very much new investment unless the pandemic passes, explained Mansur, a former senior official of the International Monetary Fund.

In Bangladesh, the work creation rate is lower than the proportion of the persons entering the workforce.

The unemployment rate is 4.2 %, according to the Bangladesh Labour Force Survey of 2016-16.

Bangladesh offers been maintaining the same unemployment price for several years and it could remain the same found in the approaching years, said the macroeconomic policy affirmation of the finance ministry. The government has, however, considered some commendable steps to woo investment.

It has taken a plan to create 100 monetary zones to create about one crore new jobs. Development focus on 93 economic zones was already approved. Included in this, permission was given to 11 EZs in the private sector, which 8 have previously commenced operations.

The government has taken in a significant amendment to the Companies Act allowing setting up of single-member companies, a maneuver that's expected to noticeably raise entrepreneurship, pull investors and support the growth of SMEs.

The federal government has formulated the new Customs Act.

The One-Stop Provider Rules 2020 has been issued to implement the OSS system in order that investors will get different varieties of investment-related services easily and quickly from government offices.

Firms looking to set up a home based business in Bangladesh needs to navigate a non-transparent and cumbersome regulatory space which includes services delivered by 34 different line companies, the World Bank said recently.

As investors re-establish but also rethink their source chains in the aftermath of the COVID-19 crisis, addressing the onerous administrative barriers to the business formation in Bangladesh is a lot more urgent, it said.

Job growth found in the garment sector features come to a good halt and overall job creation have began to decelerate from 2013.

Slowing job creation possesses stunted the transformation of the labour market, where informality and poor job quality remain typical.

Just one single in five workers are wage employed, and both formal and informal workers experience vulnerability and poor performing conditions.

Exploiting the potential for diversified export-oriented sectors because job creators will demand an improved capability to attract and service fresh FDI and domestic traders, the WB said.

The WB has approved $250 million for Bangladesh to facilitate the implementation of key reforms to market more and better jobs while supporting Bangladesh's response to the pandemic.

Bangladesh's private expenditure hovers around the 23 per cent-mark even in normal times, thus there is no possibility that it could go past 25 % in this difficult period, Mansur said.

It really is unlikely that the pandemic would vanish this season and the situation may persist even found in the second half of next yr, he said.

Bangladesh's infection level of 22 % is very high weighed against other countries, he said. The rate must be brought down to significantly less than 5 per cent to say that the problem is under control.

"Beneath the current situation, fresh investment would not happen," he said, adding that there might be some investment found in existing operations.

The country would need to remove structural challenges to take the investment to a fresh height.

Bangladesh would need to maintain macroeconomic stability, attract FDI, enhance the skill of workers, improve infrastructure and hold the cost of electricity at a good tolerable level, he said.

Personal sector credit growth target was established at 16.7 per cent in fiscal 2020-21, that was 8.61 % within the last fiscal year.

The private sector credit growth would not accelerate much as a result of the subdued demand throughout the market. The banking sector offers been suffering very long from its own group of problems, including poor loans.

However, the predicted disbursement of the majority of the stimulus packages amounting to Tk 103,117 crore may increase private credit growth. The majority of the funds would be unveiled through the banking channel.