Japanese firms bullish on Bangladesh

The majority of Japanese companies operating in Bangladesh plan to go for business expansion over the next two years thanks to cheap labour and high profitability, according to a survey conducted by Japan External Trade Organization (Jetro).

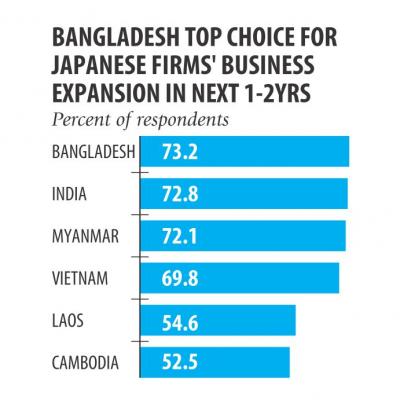

Some 73.2 percent of the 57 companies interviewed said Bangladesh is their top priority for business expansion; 61 percent said the country has high growth potential.

The findings of the survey, which was conducted among 5,073 Japanese firms in 20 Asia and Oceania countries, were unveiled yesterday by D Arai, president of the Japan-Bangladesh Chamber of Commerce and Industry (JBCCI). Out of the 20 countries, Bangladesh came in the second spot in terms of profitability for Japanese companies.

Some 62.2 percent of the Japanese companies operating in Bangladesh expect an increase in profit in 2019 from that a year earlier. The survey also found some 56.6 percent of the Japanese companies planning to increase the number of local employees in the next one year in Bangladesh.

The percentage is the fifth largest recruitment plan among the surveyed countries.

“Labour cost is the cheapest in Bangladesh in manufacturing sector,” according to the survey outcomes.

The strong presence of Japanese companies in Bangladesh is also noticed if the inflow of private companies is analysed.

Last year, the total number of Japanese companies in Bangladesh was 278, up from 260 in 2017 and 245 in 2016.

As of November last year, the amount of Japanese investment in Bangladesh by private companies is $326 million.

However, the amount is much higher if the investments made by Japanese automobile giant Honda and Japan Tobacco are included.

In August last year, Japan Tobacco Inc agreed to purchase local Akij Group's tobacco business for $1.5 billion, which is the single largest FDI in Bangladesh's private sector so far.

Also in last November, Honda inaugurated its lone manufacturing plant at Munshiganj, which it set up with the state-owned Bangladesh Steel and Engineering Corporation for Tk 230 crore.

If the amount of the state of Japan-sponsored investment through Overseas Development Assistance (ODA) in different projects is included, the amount is even bigger.

So far, the Japanese government has committed $12 billion as ODA and has already released $7 billion of the sum.

Many Japanese companies, especially the consumer and food processing companies, have been conducting feasibility studies in Bangladesh to grab the consumer market of 170 million, said Arai, who is also the country representative of Jetro in Bangladesh.

For example, Bangladesh is a very big market for diapers as the demand for the product is growing with urbanisation.

Although some local companies are manufacturing diapers, 60 percent of the demand is still met through imports, he said. The problems listed by the Japanese companies in Bangladesh include inadequate logistics and infrastructure, difficulty in quality control and shortage of skilled manpower.

Bangladesh takes the second largest clearance time from the airport and seaway compared to other Asian nations. Currently, it takes 15.6 days to get clearance for sea freights and 7.9 days for air cargo.

Taiwan takes the lowest time at 5.2 days for seaways and Hong Kong and Macau for airways: 2.2 days, the survey said.