GSK Bangladesh ricochets to profits

GlaxoSmithKline Bangladesh bounced back to profitability last year because of streamlining its business the prior year.

The British multinational shuttered its 60-year-old pharmaceuticals business in Bangladesh in 2018. The pharmaceuticals unit, based in Chattogram, was incurring losses in the last five years, much to the concern of the GSK Bangladesh board.

With the view to preventing any longer losses, the board made a decision to lower the curtains on the business enterprise.

"The bigger profit proves that the shuttering of the pharma business was the right decision," said Masud Khan, chairman of GSK Bangladesh.

In 2018, there were significant costs incurred for the factory closure in the kind of severance payment to employees etc, due to that your company recorded losses, he said.

In 2019, the impact of discontinued business was minimal. And there have been some cost-saving activities too, based on the company's posting on the Dhaka STOCK MARKET website.

"Which means this year we booked higher profits," Khan added.

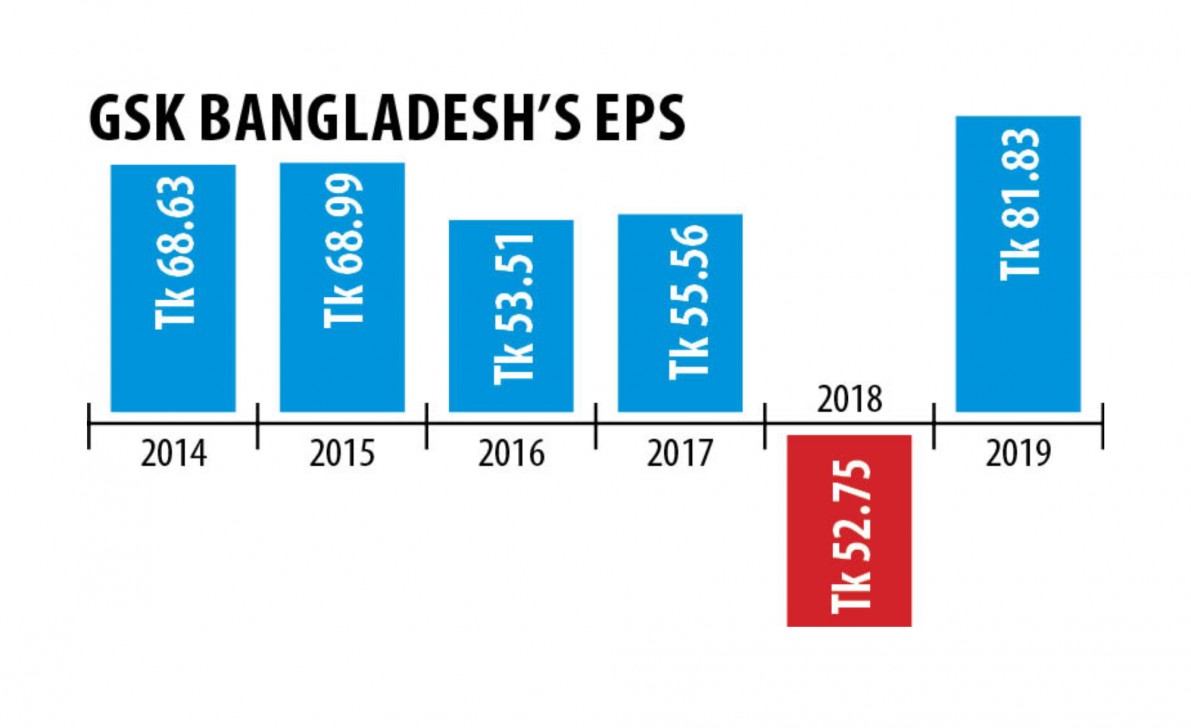

GSK's earnings per share (EPS) went up to Tk 81.83, up from Tk 52.75 in the negative in 2018.

The news headlines of high profits sent the business's stocks up 1.23 % to Tk 1,867 yesterday. GSK made its debut on the DSE in 1976.

"The pharma unit was a money guzzler," said a high official of the business preferring anonymity as he is not authorised to speak with the media.

Now, shareholders are reaping the great things about your choice, he added.

On the basis of the last year's profit GSK Bangladesh recommended 530 % cash dividend because of its general investors. Some 18 % of the business's shares are with the general public.

The British company took another monumental decision in 2018: on December 3, 2018, Unilever announced purchase of 82 % stakes of GSK's health food and drinks business in Bangladesh for Tk 1,640 crore, within the Anglo-Dutch company's push to cash in on Asia's fast-growing economies.

Additionally it is purchasing GSK's entire health food and drinks portfolio in India as well as in 20 other Asian countries for 3.3 billion euros (about $3.74 billion), after it fought off competition from rivals Nestle and Coca-Cola.

The transaction is yet to be completed, Khan said.