GSK Bangladesh had a spectacular turnaround in 2019

GSK Bangladesh's profits surged in 2019 despite the fact that the British multinational saw a decline in turnover because of the relief from incurring losses from its pharma unit.

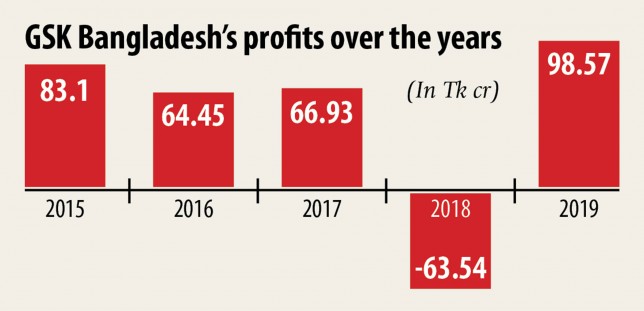

Last year, the company's profits stood at Tk 98.57 crore in 2019, up from the Tk 63.54 crore losses it had logged in for the previous year.

This year's earnings per share stood at Tk 81.83, which is its highest yet because it got listed in the Dhaka STOCK MARKET in 1976.

"The shuttering of our loss-making pharma unit has taken this lead to our balance sheet," said Masud Khan, chairman of GSK Bangladesh, yesterday.

The British multinational shuttered its 60-year-old pharmaceuticals business in Bangladesh in 2018. The pharmaceuticals unit, based in Chattogram, was incurring losses in the previous five years, much to the concern of the GSK Bangladesh board. With the view to protecting against any longer losses, the board decided to lower the curtains on the business.

In 2018, there have been significant costs incurred for the factory closure in the sort of severance pay to employees etc, due to that your company recorded losses, Khan told The Daily Star earlier in February.

In 2019, the impact of discontinued business was minimal. And there were some cost-saving activities too, according to a posting on the DSE website by GSK Bangladesh.

In 2019, its revenues amounted to Tk 447.5 crore, down 7.1 % year-on-year, because of lower sales of Horlicks, a sweet malted milk-based beverage that has been one of the crown jewels in its portfolio since ages.

Following the shutdown of its pharma unit in 2018, the business's focus turned to its consumer healthcare business, where Horlicks is its premier brand. In 2019, sales of the business's powder products, including Horlicks, dropped 11.08 % to Tk 404.17 crore.

Horlicks, that can be bought for as low as Tk 10 in sachets, increased its market penetration to 8.9 % in 2019 from 6.9 per cent in 2018.

However, the large packs of Horlicks faced a challenging market situation this season with a decline in average household consumption.

Sales of GSK Bangladesh's oral product, like Sensodyne, rose 59.75 % to Tk 43.31 crore.

"This year had not been good for health food, but we have taken steps to ensure higher sales in the current year," Khan told The Daily Star yesterday.

Now, the business is concentrating on driving penetration and distribution of its products at affordable price points such as for example in small packs.

GSK Bangladesh is focusing on bringing in new products to the marketplace too, Khan said.

The company, in the end, has no other choice if it must continue with the profit streak: on December 3, 2018, Unilever announced the purchase of 82 % stakes of GSK's health food and drinks business in Bangladesh for Tk 1,640 crore, within the Anglo-Dutch company's push to profit from Asia's fast-growing economies.

The transaction is yet to be completed, Khan said.

But for now, the business is rewarding its shareholders generously: it really is set to distribute 530 % cash dividend for the entire year ended on December 31, 2019. Some 18 % of the business's shares are with the general public.

Stocks of the multinational company traded at Tk 2,046 on March 25, the last day of trading before it continued recess for the outbreak of coronavirus in Bangladesh.