Govt’s borrowing from banks spirals

The government’s borrowing from banks has escalated alarmingly on the back of a revenue shortfall, a development that is poised to aggravate the already tight liquidity condition in the sector.

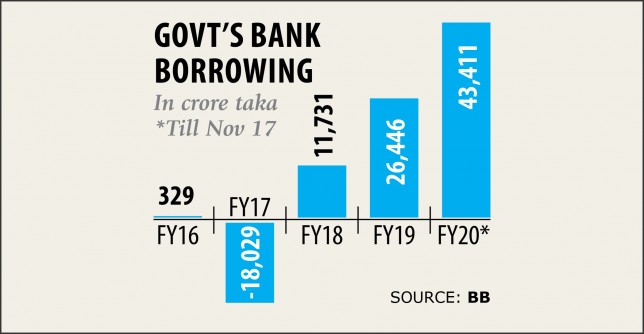

Until November 17, the government already borrowed 92 percent of its full-year target from the banking sector: Tk 43,411 crore, according to data from the central bank.

“The banking sector has been going through a liquidity crisis in recent months and the woe will further widen as a result of this,” said Ahsan H Mansur, executive director of the Policy Research Institute.

And the trend will not reverse any time soon, he said, while tipping the government borrowing from banks to hit Tk 100,000 crore at the end of fiscal 2019-20 -- more than double the target of Tk 47,364 crore for the year.

It will prolong because of the government’s imprudence in managing the macroeconomy and giving enough effort towards revenue collection, he said.

Between July and September, the National Board of Revenue managed about Tk 47,388 crore in collections against the target of Tk 62,295 crore for the period.

“The situation has raised doubts about the GDP growth rate achieved in recent years. Because, a strong GDP growth helps any government to speed up revenue collection and sidestep the aggressive borrowing from banks.”

As per the government’s calculation, Bangladesh pulled off an 8.13 percent GDP growth in fiscal 2018-19, one of the highest in the world.

The government should draw up a policy on how it will manage its spending in the months ahead to avoid bank borrowing, said Mansur, a former economist of the International Monetary Fund.

“Borrowing from foreign sources could be a good option. But the government does not have any plan to this end,” he said.

Against the backdrop, the private sector may face dire consequences if the government continues to borrow large amounts from banks, he added.

Of the total amount, the government borrowed Tk 37,374 crore from banks and the rest from the central bank.

“The government is yet to address the issue on how it will avoid its reliance on the excessive bank borrowing.”

Inclusive GDP growth will not be achieved without a proper expansion of the private sector, which would then go on to have a negative impact on employment creation, said Mansur, also the chairman of Brac Bank.

The majority of banks are caught up with repairing their balance sheets now, so they are focusing less on fresh disbursement, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a forum of private banks’ managing director.

But banks will pick up their loan disbursement from the beginning of the new calendar year and they will have face trouble then if the government continues to borrow at this rate.

The government should mobilise its required fund from alternative sources like the bond market, foreign agencies and so on, said Rahman, also the managing director of Dhaka Bank. Meanwhile, a Bangladesh Bank official said the borrowing from savings certificates and bonds has recently decreased due to a 10 percent tax on profit, he said.

“This has also forced the government to borrow more from banks,” he said.

In fiscal 2017-18 the government borrowed Tk 26,446 crore against its annual target of Tk 30,895 crore.