Global tensions fuel edible oil prices

Edible oil has seen a 20 percent rise in domestic prices in the last one month thanks to their soaring international rates, which will surely take another blow from the escalating crisis in the Middle East.

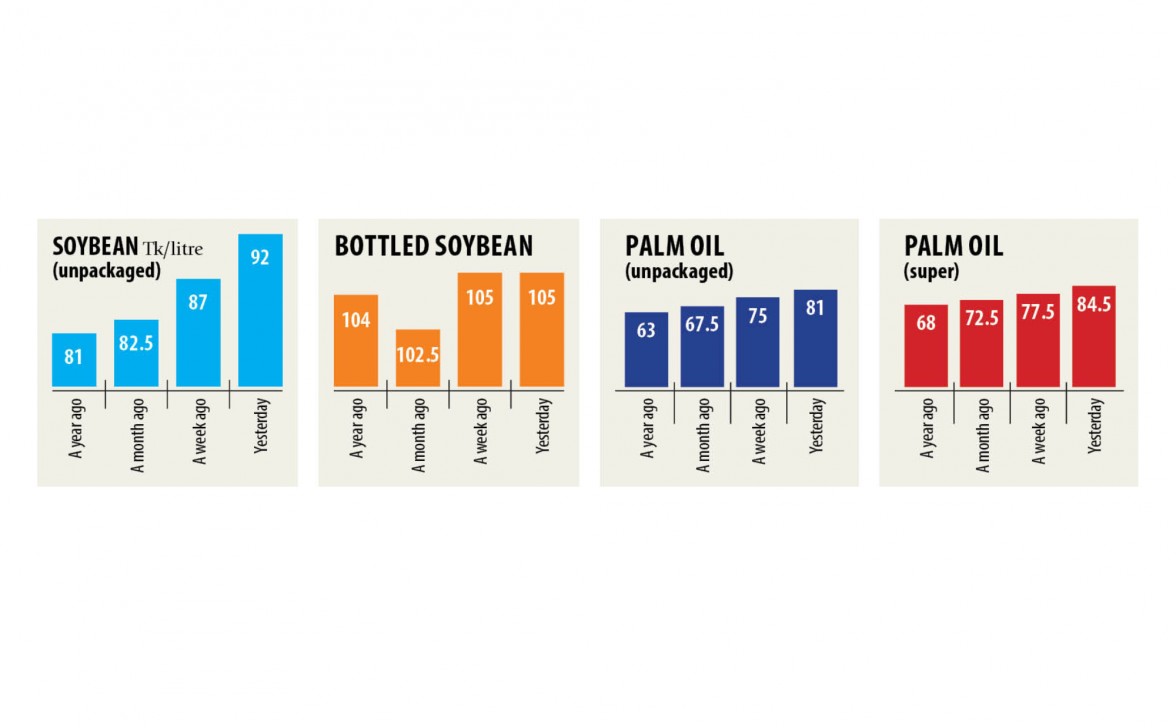

In Dhaka, a litre of loose soybean oil was traded at Tk 91-93 yesterday, up 12 percent from a month ago, while palm oil rose by 20 percent to Tk 80-82, according to the Trading Corporation of Bangladesh (TCB).

And retailers were also seen selling each five-litre container of soybean oil at 6 percent higher rates of Tk 470-515 yesterday from December 6 last year.

“We have to increase the prices as the global rates for soybean and palm oils have been going upwards since November,” said Biswajit Saha, director for corporate and regulatory affairs at City Group.

Depreciation of the taka against the US dollar has further fuelled the import costs of the group, said the official of one of the leading commodity importers and processors of Bangladesh.

Edible oil became costlier at a time when consumers were hit hard by the skyrocketing prices of onion, a key cooking item, now selling at as much as Tk 170 a kilogramme.

Bangladesh annually requires 20 lakh tonnes of edible oil and it meets almost 90 percent of its demand through import, according to a report of Bangladesh Tariff Commission.

Bangladesh mainly imports and refines crude degummed soybean oil, the prices of which soared 20 percent year-on-year to $794 a tonne on December 20, according to the report obtained from the commerce ministry.Rates of crude palm oil and refined, bleached and deodorised palmolein also rose during the same period, said the report.

Imposition of value added tax (VAT) in all stages of the value chain of edible oil further fuelled the price spiral, industry insiders opined.

Refiners in December also informed the government about the hike in price of soybean oil in the wake of soaring import costs of crude soybean and palm oils.

They have increased the retail prices of each litre of soybean oil by 8 percent to Tk 110 and to Tk 540 for each five-litre container respectively.

Global market for edible oils will remain high, as the production of palm oil was less than the demand last year, said AKM Fakhrul Alam, regional manager for Bangladesh and Nepal at Malaysian Palm Oil Council.

“The crisis in the Middle East is likely to further increase the prices of commodities and edible oils.

Insurance premium has already increased, he said.

Soaring prices of petroleum will increase freight cost too, he added.

Global oil prices surpassed $70 a barrel on Monday for the first time in more than three months as the US warned of increased threats to energy facilities in the Middle East, after the assassination of an Iranian general last week.

Annual consumption of edible oil will drop in the domestic market in 2020 as prices will be on the upward trend, Alam said.

Prices of commodities such as wheat, oil and pulses are forecast to remain upward, said Abul Bashar Chowdhury, chairman of BSM Group, a Chattogram-based commodity importer.