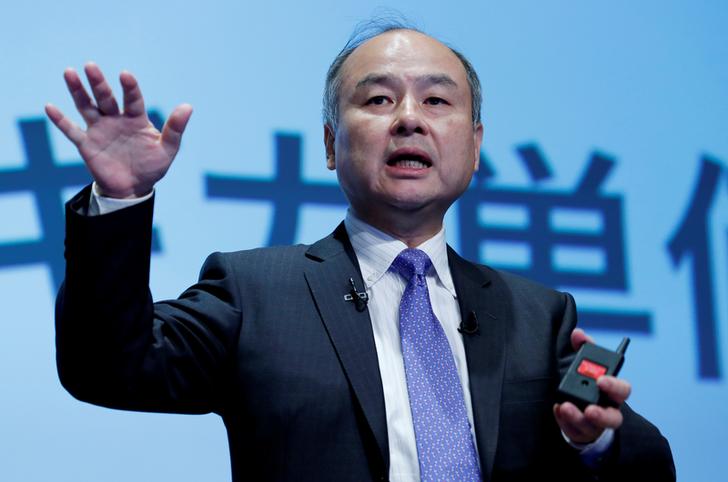

For SoftBank's Son, coronavirus turns vision to illusion

SoftBank Group Corp founder Masayoshi Son's dream of a worldwide tech empire is unravelling, with the coronavirus crisis compounding losses at his $100 billion Vision Fund and distress at his big bets portending more pain.

Over fifty percent of the fund's capital is in startups that are suffering from the virus impact or exhibiting stress pre-dating the outbreak, a Reuters analysis showed. Ride-hailing consumption at flagship transport investments has fallen a lot more than 50% and six SoftBank-backed startups have pushed IPO plans out of this year to next.

The Japanese conglomerate has recently flagged a 1.8 trillion yen ($17 billion) loss at the fund for the year to March - where Son's "intuitive" guess WeWork spectacularly imploded unsettling Middle Eastern backers which stumped up much of the fund's money.

Though many problems at portfolio firms pre-date the pandemic, the resulting monetary meltdown has exposed what critics have long named an extraordinarily risky strategy of ploughing huge sums into unproven businesses in the expectation that would enable them to dominate big new markets.

"The Vision Fund is a mess. It's been a case of a business with excess amount just splashing it around without doing enough homework," said Joe Bauernfreund, leader of SoftBank shareholder Asset Value Investors.

Son transformed SoftBank right into a tech investor in the last three years and raised the world's biggest late-stage investment fund in the Vision Fund. To be certain, some investments are doing better, but examples are scant as the pandemic magnifies problems.

The pain is specially keen in transport and real estate, which will make up $43 billion of investment and include car-share firm Getaround, home-seller OpenDoor and property brokerage Compass.

Restrictions on movement worldwide has to enter the market for the portfolio's four major ride-hailing firms, with India's Ola suspending businesses in cities in Britain, Australia and New Zealand, three persons with knowledge of the problem said.

SoftBank and Ola declined to comment.

U.S. peer Uber Technologies Inc, whose stock is stuck 40% below its 2019 initial public offering (IPO) price, last month said it had enough cash reserves to weather the crisis. Southeast Asia's Grab said its food delivery business does well. China's Didi declined to comment.

The fund will not include all $13 billion invested with SoftBank itself in office-share startup WeWork, or SoftBank's wager on satellite operator OneWeb, which filed for bankruptcy protection last month.

Among SoftBank-backed startups, at least six that have pushed back IPO plans to 2021, including BigCommerce, which powers e-commerce sites for famous brands Toyota Motor Corp and Sony Corp, said the three people, who weren't authorized to speak with media so declined to be identified.

Vision Fund guess DoorDash, a U.S. food delivery startup which earlier this season confidentially filed to go public, can be re-evaluating IPO plans given capital market volatility, a fourth person said.

DoorDash declined to comment. BigCommerce didn't respond to a request for comment.

IPOs are a essential means of raising capital for the Vision Fund, with investors such as for example Saudi Arabia's Public Investment Fund (PIF) and Abu Dhabi's Mubadala getting dividends - a unique arrangement for such a fund.

PIF and Mubadala in recent weeks have expressed fresh concern about the fund's performance and its own capability to pay dividends, said two persons directly aware of the conversations.

"As partners with a long-term view, we've discussions with(SoftBank) on ways to best optimize the fund's performance as we all navigate these difficult economical times," said a Mubadala spokesman.

PIF declined to comment.

BRIGHT SPOTS

Consumers housebound because of movement curbs has taken the portfolio some bright spots. For example, usage of short video app TikTok is growing, with Chinese operator Bytedance pledging to practically double headcount by year-end.

Orders have surged at South Korean e-commerce firm Coupang, and shares of China's Ping An Good Doctor - formally Ping An Healthcare and Technology Co Ltd - have doubled in cost year-to-date on demand for online consultation.

Overall, provided startups have sufficient cash to ride out the downturn, then recovery could follow, experts said.

But bright spots are scant.

Indian hotel startup Oyo exemplified Son's approach of providing huge sums for rapid expansion prior to the business had proven it could make money. Movement curbs have since precipitated the collapse of the global travel industry.

Oyo has backtracked on hotel income guarantees that are at the heart of its business design claiming force majeure, and is adjusting workforce and slowing expansion, the three persons said.

Oyo declined to comment.

REPUTATION

Chief Executive Son's investor credentials rest on an early guess on Chinese e-commerce leader Alibaba Group Holding Ltd. However, the billionaire has had a string of setbacks including bailing out WeWork after a failed try to float.

Startups across the portfolio have struggled to show paths to profitability or took measures such as for example cutting staff as rapid, SoftBank cash-fuelled expansion found an end.

With the Vision Fund's estimated losses, analysts said its investments are now likely valued below cost. Moreover, the troubles have left Son's plans to improve another mega-fund in tatters.

Fund backers and SoftBank stakeholders including U.S. activist investor Elliott Management have needed a committee on the board to oversee Son's big investments, the people said.

"I don't believe the Vision Fund spent some time working out quite just how many anticipated," said venture partner Ben Narasin at New Enterprise Associates. "Occasionally it's an open question concerning whether (SoftBank's) bets made sense as laid. Others were i'm all over this, but apt to be hindered by the new COVID realities."

The monetary hit from the virus has far exceeded what the fund expected in the first days of the outbreak, a Vision Fund partner said on condition of anonymity.

"In November, SoftBank indicated that about 15 of the Vision Fund companies may likely go bankrupt. Clearly the world has changed since November," said Sanford C. Bernstein analyst Chris Lane, who remains bullish on SoftBank stock. "It wouldn't surprise me if eventually about 30 of these go bankrupt."

Source: japantoday.com