Exports to India remain dismal

Despite sharing a long border, Bangladesh is still a very tiny source for merchandise for India due to a lack of diversification of products and non-tariff barriers.

India’s annual merchandise import amounts to $500 billion, in which Bangladesh’s share is only 0.2 percent, or a little above $1 billion, even though duty-free facilities have existed since 2011 for all local products save for 25 alcoholic and beverage items.

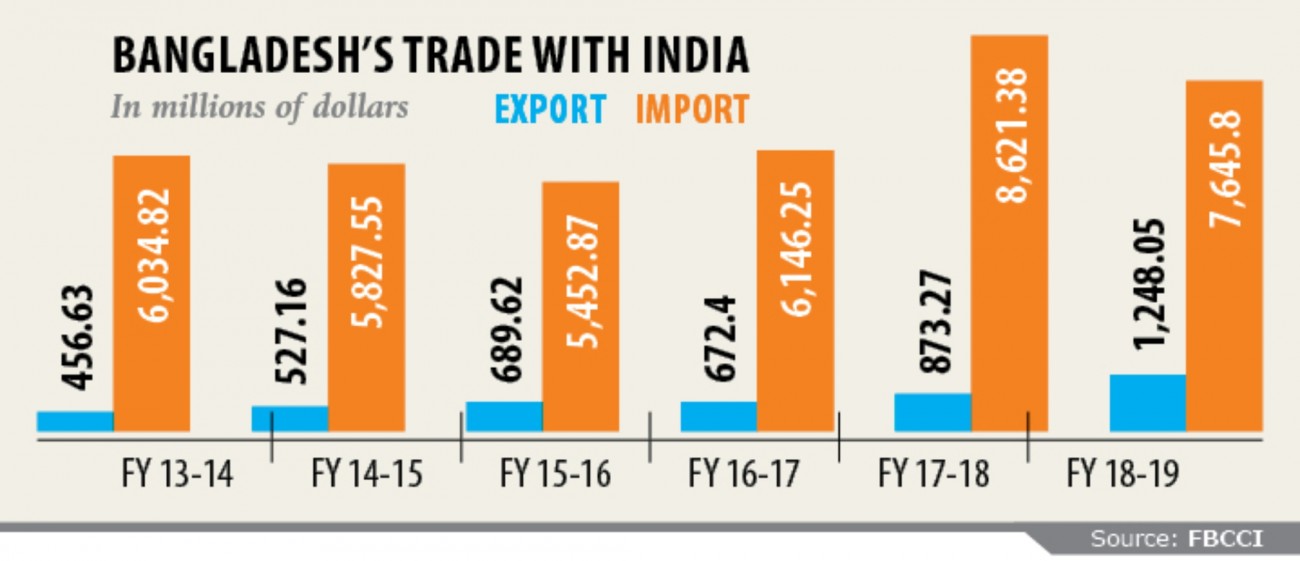

In fiscal 2018-19, Bangladesh’s merchandise shipments to India were $1.24 billion, crossing the $1 billion-mark for the first time, according to data from the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI).

Garment items dominate Bangladesh’s exports to India as its demand among the growing middle-income customers is high. Bangladesh also exports home textile, processed food, cement, furniture, leather and leather goods, but the volume is very small.

Country-wise, India’s topmost import destination is China, constituting nearly 14 percent of its imports. India imports machinery, industrial raw materials, textile fabrics and food items from China.

The other top import destinations are the US, the UAE, Switzerland, Saudi Arabia, Iraq, South Korea, Hong Kong, Singapore and Indonesia, according to the Directorate General of Foreign Trade (DGFT) of India.

Region-wise, Asia accounts for the highest imports of more than 60 percent while Europe constitutes a little above 16.36 percent.

India’s main import items are crude, gold, petroleum products, coal, pearl, precious metals, telecom instruments and organic chemicals.

However, Bangladesh does not have those products. Still, exports from Bangladesh are growing mainly for the duty-free facility for garment shipments.

Bangladesh’s garment export to India is on the rise thanks to the presence of global retail giants like H&M, Zara, Mango, Wal-Mart in the neighbouring country. All the retailers source from Bangladesh heavily.

However, Abdul Matlub Ahmad, president of the India Bangladesh Chamber of Commerce and Industry, said some 40 Indian companies have their operations in Bangladesh and they send back the goods produced here to India, especially to the Northeastern states.

“This is one of the major reasons for the high exports to India from Bangladesh,” Ahmad said.

The non-tariff barriers (NTB) and anti-dumping duties on jute have had a detrimental impact on Bangladesh’s export to India, said Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue.

A lack of adequate trade facilitation is the most important NTB for operators on both sides, Rahman said.

Imports from India are mostly raw materials for Bangladesh’s export-oriented sectors, particularly the apparel industry.

Notably, 87 percent of Bangladesh’s exports to the US are garment items, which are, in part, made of cotton, yarn and fabrics imported from India, according to Rahman.

Thanks to this, Bangladesh has a significant trade surplus with the US: $6.1 billion in 2018.

“But reducing the bilateral trade deficit with India remains a major point of contention in the Bangladeshi policy circle and public opinion.”

Bangladesh has not been able to take advantage of India’s growing appetite for imports. Indian imports exceeded $400 billion in 2018.

“India is importing many items from the global market but not from Bangladesh. Bangladesh is exporting these same items to the global market but not to India.”

Policymakers must remove the barriers to the bilateral trade flows through appropriate policies, Rahman said.

About 50 percent of bilateral trade between Bangladesh and India takes place through land ports. The border points are not crossing points — they are control and checkpoints.

Goods need to be unloaded and reloaded in ‘no man’s land’, leading to delays and cost escalation. In the absence of mutual recognition agreements, goods have to wait for several days until inspection results come from laboratory facilities in distant testing centres.

The costs of transporting goods from Dhaka to Delhi are significantly higher than those from Dhaka to Europe and the US, he said.

“Overall, the bilateral relationship is showing early signs of developing positively over the long term. But there is a long way to go if Dhaka wants to fully reap the potential benefits of deeper Bangladesh–India bilateral ties.”