Export subsidy gets bigger

The government is set to extend export subsidy to eight new products and increase the amount for existing ones with a view to boosting overseas shipments and encouraging environment-friendly industrialisation.

The decision, which was taken last week at a meeting chaired by Finance Minister AMA Muhith, will soon be conveyed to the central bank for implementation.

The export target for this fiscal year is $44 billion, which is about 20 percent more than fiscal 2017-18's receipts.

At present, cash incentive ranging from 2-20 percent is given to 26 product categories.

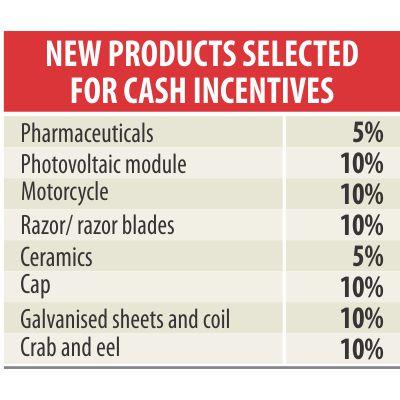

The new products that will get export subsidy are: pharmaceuticals, photovoltaic modules, locally assembled motorcycles, razor and razor blades, ceramics, prayer caps, galvanised sheets and coils, and crabs and eels.

They will get cash incentives of 5-10 percent.

After meeting 97 percent of the country's demand, 107 medicines are exported. Now, those shipments will bring 5 percent cash incentive, provided there were 30 percent value addition.

Photovoltaic module is a new entrant to Bangladesh's export basket. With the view to boosting its overseas shipment, 10 percent cash incentive will be extended on their export, provided there was value addition of 30 percent.

Export of locally assembled motorcycles will bring 10 percent incentive on condition of 30 percent local value addition.

Considering the huge demand for low-priced razor and razor blades in least-developed countries, the products have been granted 10 percent cash incentive provided there is value addition of 40 percent.

After meeting the local demand for ceramics, they are exported to more than 70 countries. However, the machineries, technology and raw materials are imported, against which the sector currently enjoys duty facility.

Going forward, the duty facility will be withdrawn and replaced with 5 percent cash incentive but on condition of 30 percent value addition.

The export of prayer caps will be extended 10 percent cash incentive but the local value addition must be 30 percent.

Export of crabs and swamp eels, provided they get the clearance from the environment ministry, will get 10 percent cash incentive.

Galvanised sheets and coils will be given 10 percent incentive, provided there is 30 percent value addition.

Some of the existing product categories will see an increase in their export subsidy quotient.

One of the product categories is jute and jute goods. At present, diversified jute goods get 20 percent cash incentive, finished jute products 10 percent and jute yarn 5 percent.

Going forward, their cash incentives will increase 2 percentage points. However, the definition of diversified jute goods will be re-set.

At present, the export of paper and paper products, active pharmaceutical ingredients and accumulated battery enjoy 10, 20 and 15 percent cash incentive respectively.

But, the industries set up in the export processing zones and economic zones do not get the facility as they enjoy various tax cuts. From now onwards, they will get the incentives and their tax benefits will be withdrawn.

At present, only the leather industries that have shifted from Hazaribagh to Savar get export subsidy. But now, all factories with the central effluent treatment plant will get 10 percent cash incentive.