Edible oil prices hauled up by VAT

The imposition of value-added tax (VAT) and advance tax (AT) in the value chain of edible oil are contributing to the spike in prices of the essential cooking ingredient, said a Bangladesh Tariff Commission report.

And the burden of the indirect tax will further increase the burden on the wallets of consumers from all walks of life amid soaring global prices of soybean and palm oil, which the nation has to depend largely to meet its consumption requirement.

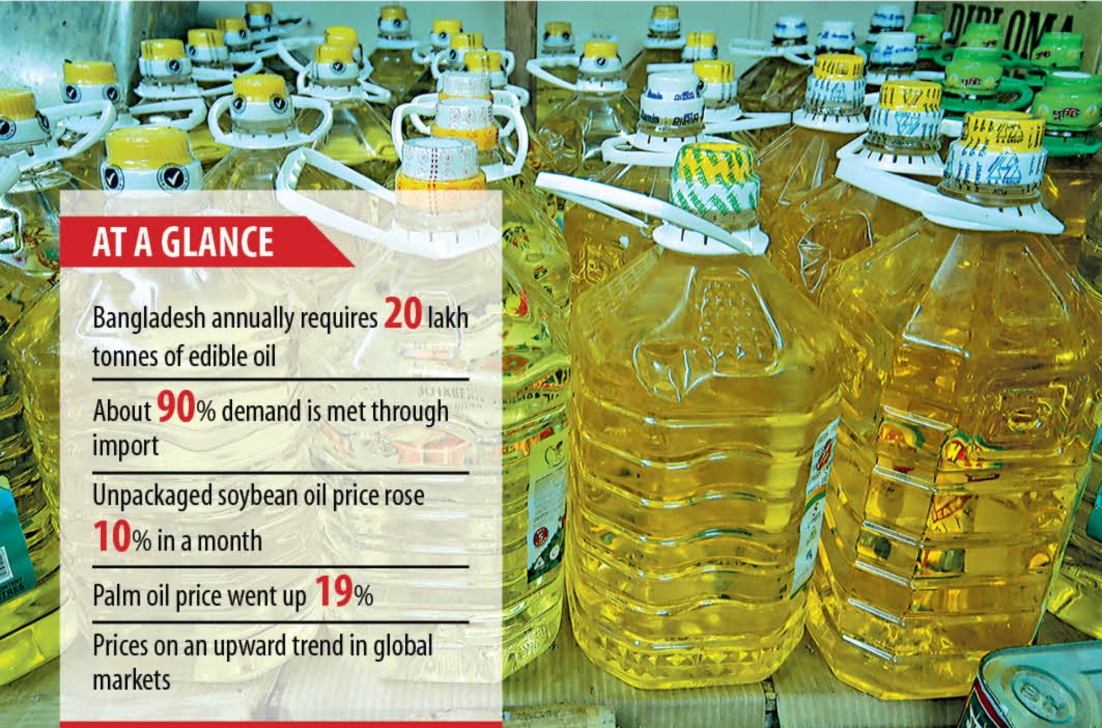

Bangladesh annually requires 20 lakh tonnes of edible oil and it meets almost 90 percent of its demand through import.

The commission’s observation comes at a time when processors have hiked the prices of edible oil to transfer the burden of higher international prices and increased VAT onto the shoulders of consumers.

Yesterday, a litre of loose soybean oil traded at 10 percent higher at Tk 91-93 from a month earlier in Dhaka. Retailers sold palm oil in unpackaged form at 19 percent higher prices at Tk 80-82 per litre, according to market data compiled by the Trading Corporation of Bangladesh.

And prices of each five-litre container of soybean rose 5 percent to Tk 470-Tk 515 from December 8 last year.

The BTC document, which was submitted to the commerce ministry recently, said the tax authority levied 15 percent VAT on import, production and distribution of soybean and palm oil from this fiscal year, ending the previous rule of collecting the indirect tax at the import stage.

Also, the National Board of Revenue (NBR) levied a 5 percent AT on imports under the VAT and Supplementary Duty Act 2012, which came into effect from fiscal year that began on July 1, 2019. The revenue authority says the AT is adjustable and it has introduced the tax to encourage businesses to keep records of transactions and accounts properly.

As a result of the changes in VAT structure, import costs of crude degummed soybean oil (CDSO) and refined, bleached and deodorised (RBD) palmolein, which local refiners import and process to market locally, have soared, according to the BTC report.

For example, the report, quoting letters of credit settlement data of CDSO and RBD palmolien from May 2019, said edible oil refiners paid Tk 8,700 and Tk 6,390 for each tonne of CDSO and RBD palmolien.

The amount of VAT, a type of consumption tax, increased 41 percent to Tk 12,252 for each tonne of CDSO after imposition of VAT and AT on imports.

For palmolien, the additional cost rose 45 percent to Tk 9,280 per tonne, according to the BTC report.

Besides, as distributors and businesses cannot maintain records of transactions and accounts properly, they have to pay 5 percent VAT on sales price.

“This has created the possibility of price hike of edible oil,” the BTC report said.

The BTC also linked depreciation of taka and rising prices of soybean and palm oils in the global market to increase in prices of the essential commodity in the local market.

The report said refiners have been seeking to increase the prices of edible oil since the beginning of the fiscal year for the imposition of VAT and AT on imports but the commission advised refiners to refrain from doing so.

The prices of edible oil remain a bit stable for exemption of AT on import of crude edible oil.

But as prices of the commodities have been rising since October, refiners have been seeking commission’s nod to increase prices, the report said.

The prices of both CDSO and RBD palmolien surged 20 percent and 35 percent year-on-year on December 20 last year.

Under the circumstances, the commission suggested reduction of VAT on production, distribution and trading stages and fixation of sales commission for distribution and retailing at Tk 3 and Tk 5 respectively.

It also recommended the government for exemption of 5 percent AT on imports of crude edible oil to curb the price spiral of the key item in the face of soaring global prices.