Depositors up in arms over 6pc interest

Anxiety gripped Ahmed Kabir the instant he learnt from the morning paper yesterday that the government has decided to fix a uniform interest rate for all types of deposits from April 1.

Kabir had parked all his retirement benefits as fixed deposit receipts in banks after leaving his job as a teacher in a government school three years ago. The Cox’s Bazar native got 9-9.5 percent interest against them, enough to live a comfortable life in his senior years.

“No bank will be allowed to take deposits beyond 6 percent as per the prime minister’s instruction,” Finance Minister AHM Mustafa Kamal told reporters on Monday after a meeting with private banks’ sponsors and managing directors, where the decision was made.

The development is a brutal blow for pensioners like Kabir. “I am now feeling uneasy. Will I have to adjust my lifestyle?”

If the new rate is implemented, savers will not get any benefit from banks given the ratio of inflation and service charge imposed by banks, said Khondkar Ibrahim Khaled, a former deputy governor of the central bank.

Inflation leapt 45 basis points in November to 6.2 percent, a 25-month high.

The new decision, which was taken to facilitate single-digit interest rate for lending with a view to spurring private investment, will not just affect pensioners but also the fixed income group, who usually keep a portion of their income every month in deposit pension schemes (DPS).

Banks too will have to count losses because of the latest decision as they will have to continue their existing fixed deposit receipts (FDRs) and DPSs while giving out loans at 9 percent, said the managing director of a private bank, wishing not to be named.

“Our woes may be softened a bit if the government actually keeps its fund in private banks.”

The government has deposited Tk 200,002 crore in the banking sector, but the majority of the sum is with state-run banks, he added.

People will simply stay away from banks when it comes to depositing their money, possibly triggering a liquidity crunch for lenders, according to Khaled.

They might head back to savings instruments, which carry 11.04-11.76 percent interest.

Because of their high interest-bearing nature, their sales hit a staggering Tk 49,939 crore last fiscal year.

To reduce the appetite for the savings tools, the government from this fiscal year has lowered the ceiling. And to ensure the ceiling is not breached, the government digitised the system.

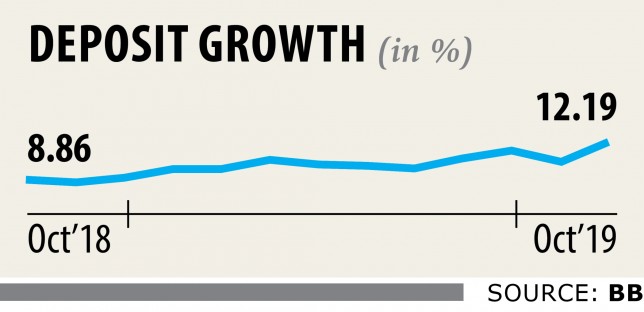

This led to a spike in bank deposits, said a Bangladesh Bank official.

He fears that people will now invest their money in land and capital market and avoid banks entirely. A section of them will even try launder money abroad.

But pensioners like Kabir, who are not as investment-savvy and are shut out from those options, are at wits’ end.

“I really don’t know what to do.”