Crystal Ins shares see surprise rise in demand

An abnormal surge in the stock price of newly listed companies is still a common scenario in the neighborhood market, where these overvalued shares in the end leave an impact on the investors.

Crystal Insurance, which debuted yesterday, is no exception as the business's stocks saw four times higher demand than its free float shares.

On the first day of trading, the insurer saw a purchasing demand of 5.48 crore shares despite the fact that its free float was 1.6 crore shares.

Besides, only one trade was executed yesterday, when a single initial public offering (IPO) winner sold 500 shares at Tk 15 each, according to DSE data.

This was due to a lack of sellers amid a higher turnout of buyers, which led the company's trade being halted for your day.

A number of the IPO lottery winners want to buy the shares as they hope the stock value will dsicover a substantial rise soon, a stock broker said.

The problem of overvaluation was previously criticised by market analysts and so the Bangladesh Securities and Exchange Commission (BSEC) implemented a new system where in fact the value of newly listed stocks cannot rise a lot more than 50 % in the first couple of days.

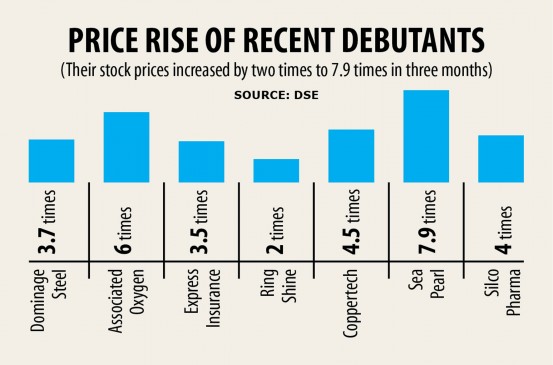

But still, a number of debutant companies saw their share values to be tripled despite the fact that their prices eventually drop a few months after listing.

For example, Coppertech Industries' stock price rose to Tk 42 in the first couple of days carrying out a face value of Tk 10. After just three months though, its value dropped to Tk 18.

Folks are rushing for newly listed companies without realising their track record and tendency to supply dividends, the broker said, adding that investors have to be more careful.

Actually, the investors hope that Crystal Insurance will start to see the same rise that was seen for Express Insurance, according to Abdur Rashid, a stock investor.

Express Insurance was prevented from rising over 50 % in the first couple of days of listing but from then on, it rose continuously going to Tk 35 within a few months.

"Before tendency stops, newly listed companies will be overvalued and stock investors will still be impacted," Rashid added.

Gamblers help create fake demand and create a craze among investors, said a top official of a merchant bank.

"As they saw there have been no sellers, they influenced the demand on the trading board at the Dhaka Stock Exchange and the IPO winners became more hopeful seeing the bigger demands," he said.

If the BSEC takes action after seeing proof of this through its surveillance system, then your real manipulator will be caught and the problem will be reduced, he added.

"We've already initiated a circuit breaker so that debutant stocks cannot rise abnormally in the first two days," said BSEC Spokesperson Rezaul Karim.

Earlier, there is no circuit breaker for share values in the first days of listing however now, a debutant company's stock price is limited to a 50 per cent rise for the first two days.

After that, it really is bound to follow the normal circuit breaker of 10 per cent deviation.

"If the investors don't realise this, then how can it be controlled," he said, adding the tendency of abnormal price hikes slightly reduced following the circuit breaker was implemented.

When issue size will be higher, then people's expectation will be reduced and the procedure will be eased, Karim said.