Credit growth sinks to 56-month low

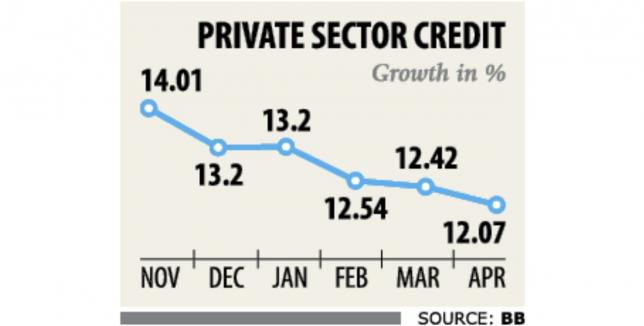

Private sector credit growth sank to a 56-month low of 12.07 percent in April on the back of the ongoing liquidity crunch in the banking sector, in an ominous development that stands to slow down the economy’s tremendous growth momentum.

The growth is 4.43 percentage points less than the central bank’s target of 16.5 percent for the second half of the fiscal year. In the last two fiscal years, private sector credit growth hovered between 16 percent and 18 percent, only to dip at the turn of the fiscal year.

The declining trend will continue in the months ahead as the government is not bothered about addressing the problem, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

One of the main reasons for the low credit growth is banks’ subdued deposit growth. “Neither the government nor the central bank has taken the matter into account,” he said.

Against the backdrop, many local businesses are now borrowing from foreign lenders because of the existing liquidity crisis and high lending rate, Mansur said.

“But, taking funds from foreign lenders is widening the financial risk.”

If the exchange rate of the taka drops against the US dollar, businesses would have to pay more, which would then have an adverse impact on the foreign exchange reserves, Mansur said.

The lower credit growth is an indication that the expansion of the private sector will grind to a halt in the near future, which will subsequently hit the GDP growth, said Mansur, also a former economist of the International Monetary Fund.

The economy is expected to expand at more than 8 percent this fiscal year and the next, catapulting it to the top three fastest growing nations in the world.

Without further ado, the government should cut the interest rate on national savings tools to stave off brewing tension in the private sector, Mansur said.

“This is pivotal to strengthening the liquidity base of lenders.”

The continuous slide in credit growth has already created a vulnerable situation for both banks and the economy, said AB Mirza Azizul Islam, a former adviser to a caretaker government.

If the trend of declining credit growth prolongs, profitability in the banking sector will shrink as lending is banks’ main income generator.

“Banks will have to recover their default loans at any cost to get rid of the liquidity crisis,” Islam added.

The majority of the banks are now under pressure to adjust the loan-deposit ratio as per the central bank’s instruction, said MA Halim Chowdhury, managing director of Pubali Bank.

Banks are now disbursing fresh loans in a cautious manner to maintain the ratio, which has ultimately hit the credit growth.

“Besides, the agreement between the government and the private banks’ sponsors to keep the interest rates for saving and lending at 6 and 9 percent respectively has also created a physiological problem for lenders.”

Many lenders are unwilling to disburse loans at 9 percent interest rate as they have to gather funds at a much higher rate, he added.