Closure of Shyampur Sugar leaves stock investors found in the lurch

Shyampur Sugar Mills recently announced that it could stop sugarcane processing for all of those other current fiscal 12 months, a development which has left its stock investors in circumstances of uncertainty.

The company's decision to avoid processing sugarcane for a year is only going to enhance its damage burden and lead to further woes for investors, said stock investor Abdullah Hujaifah.

Shyampur Sugar took your choice to turn off the mill on December 2 as per instructions from the Ministry of Industries.

Within the government notice, local sugarcane farmers who traditionally supplied Shyampur sugar would now instead divert their supplies to other nearby mills.

"But what is based on wait next for us is the question," Hujaifah added.

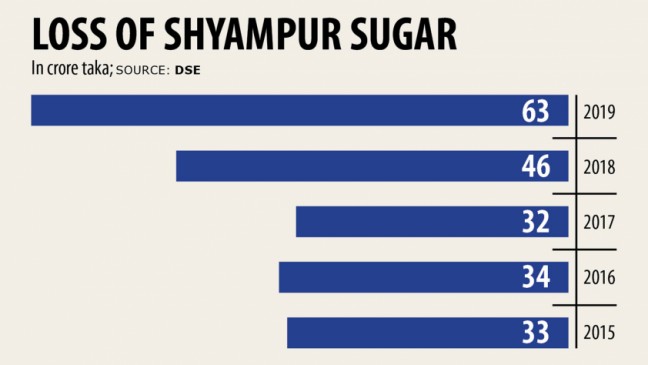

The business auditor said in its report for the year that ended on June 20, 2020 that taking into consideration the recurring losses, high production cost, net capital deficiency and classified loans, there is significant doubt over its sustainability without government support.

Because the company continues to suffer losses, its net capital deficiency had reached Tk 494.68 crore in total and Tk 989 per share towards the end of the entire year, the auditor said.

Reading the audit article published recently upon the Dhaka Stock Exchangewebsite, many investors today dread that the mill will come to be turn off permanently, Hujaifah said, adding that the mill's personnel were already protesting your choice.

Meanwhile, stocks of Shyampur Sugar out of the blue dropped following a announcement, which had shareholders feeling "pour not normal water on a drowned mouse", he added.

The business's share price fell 23 % to Tk 52 following the announcement although it had since increased 3.69 % to Tk 59 as of yesterday.

Shyampur Sugar is highly recommended different from all of those other state-run mills because it is listed with the country's bourses and has many investors, said a top official of a secured asset management company.

"If there is any possibility to diversify the business's products or rebound gains, the effort ought to be made," he said.

Because the company has been incurring losses for quite some time now, it's important to take drastic steps to change the situation.

"So, I welcome your choice of modernisation," he added.

However, the official continued to say that the business should inform investors about how the mill would be modernised.

A top official of Shaympur Sugar, preferring anonymity, said the Bangladesh Glucose and Food Industries Corporation (BSFIC) informed them through a letter that state-run glucose mills have been incurring losses for some time for several causes, including declining production capacities and bigger production costs.

In its letter, the BSFIC announced that in a bid to curb losses and modernise the present facilities, six mills would be shuttered until further notice.

"Therefore, the factories happen to be being shut as part of a push to reform and modernise the sector but there was no specific system included," the BSFIC official stated.

The six sugars mills are of Pabna, Shyampur, Panchagarh, Setabganj, Rangpur and Kushtia.

The federal government holds a 51 % stake in Shyampur Sugar while institutional investors 1.69 % and general investors the rest of the 47.31 %.

The company auditor provided a professional opinion in its audit report predicated on some of their findings.

The auditor said the business was only in a position to earn Tk 60,000 on the average per tonne of sugars while the corresponding cost of production was Tk 2.75 lakh, which effectively creates a net lack of Tk 2.15 lakh out of every tonne.

It also discovered that the company's loan balance stood at Tk 25.60 crore and Tk 164.49 crore as long term and short term debt respectively.

"Both loans were classified by the lending bank because of non-repayment," the auditor said.

"We have not decided to shut down the factory permanently but instead halt production for one yr," explained BSFIC Chairman Sanat Kumar Saha.

The federal government took this decision so as to modernise the facility, he said.

"The company educated us that its sugarcane processing has been stopped for one time so we happen to be keeping the company's activities on our look at list," explained Mohammad Rezaul Karim, spokesperson of the Bangladesh Securities and Exchange Commission.

"We have previously sat with the business and told them to ensure that investors are not hurt by some of their decisions," Karim stated.