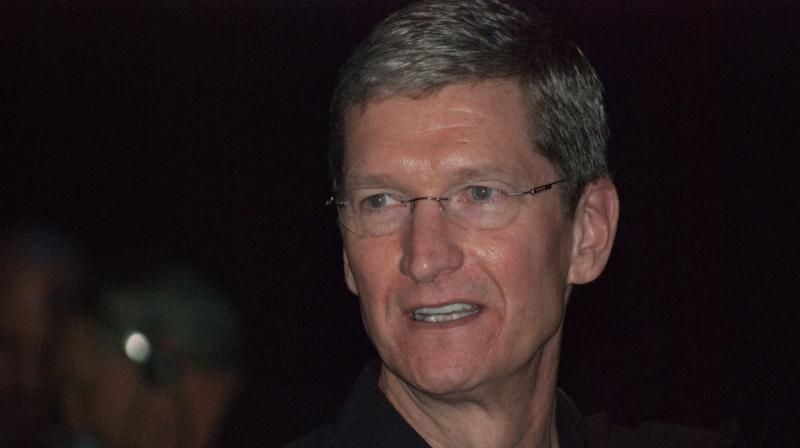

Charges of dominance mar Apple’s $2 trillion success under Tim Cook

When Tim Cook took over after Steve Jobs’ death in 2011, Apple was worth just under $400 billion; it’s worth five times a lot more than that today, and has just end up being the first US company to boast market value of $2 trillion. Its share performance has easily eclipsed the benchmark S&P 500, which has roughly tripled in value in the past nine years.

But it hasn’t been easy. Among the challenges Cook has faced: a slowdown in iPhone sales as smartphones matured, a showdown with the FBI over user privacy, a US trade war with China that threatened to force up iPhone prices and now a pandemic that has closed many of Apple’s shops and sunk the economy into a deep recession.

Cook, 59, in addition has struck out in into novel territory. Apple now pays a quarterly dividend, a step Jobs resisted partly because he associated shareholder payments with stodgy companies which were past their prime. Cook also used his powerful perch to be an outspoken advocate for civil rights and renewable energy, and on a personal level came out as the first openly gay CEO of a Fortune 500 company in 2014.

Apple declined to make Cook designed for an interview. Nonetheless it did indicate 2009 comments Cook designed to financial analysts when he was running the business while Jobs battled pancreatic cancer.

Asked what the company might appear to be under his management, Cook said that Apple needs “to possess and control the principal technologies behind the merchandise we make.” It has doubled down on that commitment, learning to be a major chip producer so that you can supply both iPhones and Macs. He added that Apple would resist exploring most projects “in order that we can really focus on the few that are truly important and meaningful to us.”

That laser focus has served Apple well. As well, though, under Cook’s stewardship, Apple has largely didn't develop breakthrough successors to the iPhone. Its smartwatch and wireless ear buds have emerged as market leaders, however, not game changers.

Cook and other executives have dropped hints that Apple wants make a major splash in neuro-scientific augmented reality, which uses phone screens or high-tech eyewear to paint digital images in to the real life. Apple has yet to provide, although neither have others that contain hyped the technology.

Apple also remains a laggard in artificial intelligence, particularly in the increasingly important market for voice-activated digital assistants. Although Apple’s Siri is trusted on Apple devices, Amazon’s Alexa and Google’s digital assistant have made major inroads in assisting persons manage their lives, particularly in homes and offices.

Apple also offers stumbled several times under Cook’s leadership.

In 2017, it alienated customers by deliberately but quietly slowing the performance of older iPhones with a software update, ostensibly to spare the life of aging batteries. Many consumers, though, viewed it as a ploy to improve sales of newer and more costly iPhones. Amid the furor, Apple offered to replace aging batteries at a steep discount; later it paid $500 million to settle a class-action lawsuit over the problem.

Apple in addition has faced government investigations into its aggressive efforts to minimize its corporate taxes and complaints that it has abused control of its iphone app store to charge excessive service fees and stifle competition to its digital services. On the tax front, a court ruled in July that Apple did nothing wrong.

Cook has turned the software store into the cornerstone of a services division that he set out to expand four years back. At the time, it had been growing clear that sales of the iPhone-Apple’s biggest money maker-were destined to slow down as innovations grew sparse and consumers kept their old devices for longer.

To greatly help offset that trend, Cook commenced to emphasize recurring earnings from app commission, warranty programs and streaming subscriptions to music, video, games and news sold for the more 1.5 billion devices already running on the company’s software.

Apple’s services division now generates $50 billion in gross annual revenue, more than all but 65 companies in the Fortune 500. Ives estimates Apple’s services division alone is worth about $750 billion-about exactly like Facebook currently is in its entirety.

That division could possibly be worth even more now had Cook done something many analysts believe Apple must have done at least five years back by dipping into a hoard of cash that at one point surpassed $260 billion to get Netflix or a significant movie studio to fuel its video streaming ambitions.

Buying Netflix seemed like within the realm of likelihood five years ago when the video streaming service was valued at around $40 billion. Given that Netflix is worth more than $200 billion today, that idea appears off the table, even for a company with Apple’s vast resources.