Businesses on same page with govt over VAT law

Businesses are on board with the government's plan to introduce four different rates of value-added tax (VAT) from July, clearing the way for the implementation of the much-talked about VAT law 2012.

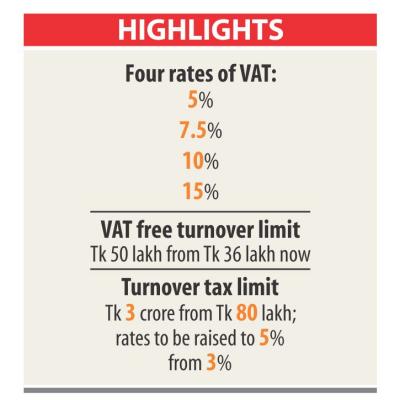

As per the scheme, there will be four different rates of VAT applied on most of the goods and services under the existing VAT law 1991: 5 percent, 7.5 percent, 10 percent and 15 percent.

“We have agreed in principle and will fix the remaining issues later,” Shafiul Islam Mohiuddin, president of the Federation of Bangladesh Chambers of Commerce and Industry, told reporters after a meeting yesterday with Finance Minister AHM Mustafa Kamal.

Representatives of the top trade bodies, revenue officials and Salman F Rahman, the prime minister's adviser on private industry and investment, were present among others at the meeting held on the premises of the planning ministry.

Over the next two months, the National Board of Revenue (NBR) in consultation with businesses will slot the sectors into the four VAT rates.

“Businesses have accepted the 5 percent, 7.5 percent and 10 percent rates of VAT,” Kamal told reporters after the meeting.

The introduction of multiple rates would require amendment of the VAT and Supplementary Duty Act 2012 as it envisaged a uniform 15 percent rate, according to NBR officials familiar with the law.

The new law, which was framed at the prescription of the International Monetary Fund to boost revenue collection, was not received well by businesses.

It was scheduled for implementation under an automated environment from 2015 but was deferred on several occasions, with the most recent being in 2017 -- just days before it was due to take effect on July 1.

The government postponed its implementation by two years amid pressure from a section of businesses and lobby groups.

The 15 percent standard rate would remain in sectors such as cigarette, telecom and gas, said NBR Chairman Md Mosharraf Hossain Bhuiyan after the meeting.

“We will fix the rates of VAT in the budget proposal. We have also hiked the threshold of VAT-free turnover ceiling and decided to rationalise the turnover tax,” Bhuiyan said.

The VAT-free turnover limit would be increased to 50 lakh from existing Tk 36 lakh, said a senior NBR official.

The ceiling of turnover tax would be increased to Tk 3 crore from Tk 80 lakh, and the rate of turnover tax would be hiked to 5 percent from 3 percent at present, he added.

“All will have to pay VAT,” Bhuiyan said, adding that the government would provide electronic fiscal device so that the VAT paid by customers come to the state coffer.

Meanwhile, the budget for fiscal 2019-20 will be placed in the parliament on June 13, Kamal said.

“There will be nothing in the coming budget that will affect businesses. This government in no way will question business by anti-corruption commission, customs and police. It will also not think of sending business to prison,” the minister added.