Bring down corporate tax

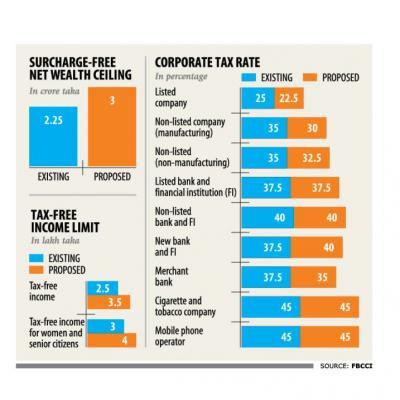

The country’s apex trade body yesterday demanded a 2.5 percentage point reduction in corporate tax for both listed and non-listed companies and a hike in tax-free income limit for individual taxpayers for fiscal 2019-20.

The Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) appealed for fixing the tax rate for manufacturing companies at 30 percent for next fiscal year to encourage investment and job creation.

Also, it urged the government for extension of loan rescheduling facility for small borrowers in line with big borrowers.

Large borrowers have got rescheduling benefit for 20 years.

“But why don’t those who borrowed Tk 1-5 lakh get the same benefit? We do want any discrimination. We want transparency and accountability,” said outgoing FBCCI President Shafiul Islam Mohiuddin while placing the proposals for the incoming fiscal year on behalf of the business community.

The National Board of Revenue and the FBCCI jointly organised the meeting at the Bangabandhu International Conference Center.

At the meeting, the FBCCI demanded automaton of tax administration, removal of advance income tax on imports, increased incentives for exports, hike in surcharge-free net wealth threshold and multiple rates of VAT.

The apex chamber welcomed the finance minister’s decision to introduce multiple rates of VAT instead of a single rate and increase the VAT-free turnover limit to Tk 50 lakh annually from Tk 36 lakh.

It however suggested reduction of turnover tax rate to 3 percent in place of 4 percent.

The FBCCI also raised the issue of input tax credit under multiple VAT rates and said an ambiguity still remains on the rates of VAT for products and services where tariff value or administered value are applied now.

On the other hand, it is still not clear about how the issue of input tax credit would be fixed under multiple VAT rates, Mohiuddin said.

On the matter, NBR Chairman Md Mosharraf Hossain said VAT rebate would be applicable for products and services that face 15 percent VAT rate.

The business community should not be worried about the impact on them for the implementation of the VAT law.

“If any problem arises later that could be addressed. So we will expect that there will no barrier to implementation of the VAT law this time,” he added.

The implementation of the new VAT law has been delayed for two years amid opposition of the business community.

Finance Minister AHM Mustafa Kamal, who was present at the meeting, said the rates would be 5 percent, 7.5 percent and 10 percent.

Rubana Huq, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), demanded easing of the process so that exporters can get incentives without hassle.

She also suggested formation of a fund to support entrepreneurs who are not wilful defaulters.

The FBCCI also appealed to the government to take steps to bring down the non-performing loans and put an end to lending on political consideration.

It also urged for taking actions against wilful loan defaulters and support for those who could not service loans timely even though they wanted to.

“At this moment, the bank interest rate is increasing abnormally. The Bangladesh Bank should take initiative and oversee strongly to establish discipline in the banking sector,” Mohiuddin said.

AK Azad, former president of the FBCCI, suggested formation of special tribunal for speedy disposal of loan-related cases that are pending in various courts.