Banglalink knocked down further by pandemic

Banglalink, after the most-spirited operator in the united states but has since fallen behind in competition, is slipping further for the pandemic.

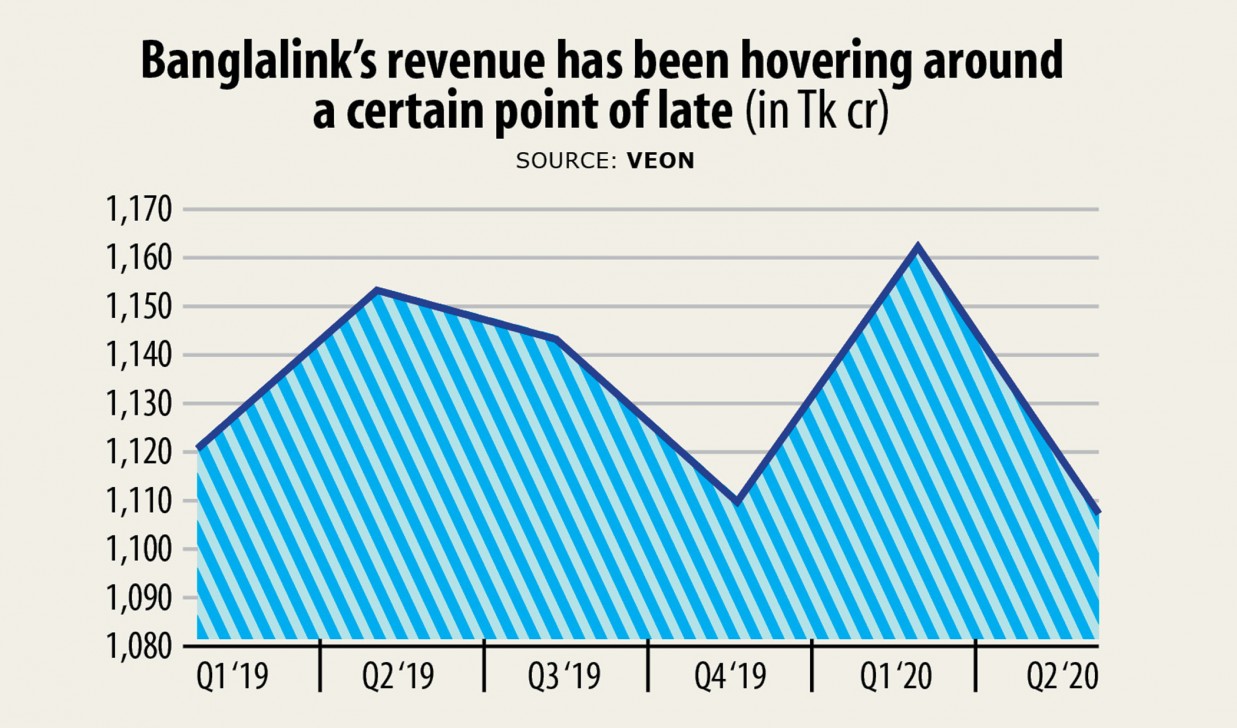

The industry's number 3 carrier logged in Tk 1,108 crore in earnings for the April-June quarter, down 4.7 % from the prior quarter and 4 per cent from a year earlier, according to a written report published by its parent company Veon on Thursday.

Bangladesh reported its first confirmed cases of COVID-19 on March 8 and flatten the curve on the rogue virus the government put the united states on shutdown three weeks later. The shutdown, which effectively forced the economy to take a hit, was lifted on, may 30.

Earlier, market leader Grameenphone reported negative growth for the next quarter, while Robi, the country's second major operator, said it is bleeding for the pandemic, nonetheless it did not disclose any numbers.

The hike in supplementary duty on telecom services in the budget fiscal 2020-21 also affected Banglalink's earnings for the quarter.

The supplementary duty has been increased from 10 % to 15 per cent, which increased the price tag on all telecom services. The bigger supplementary duty took effect from June 12.

Like in the last years, the carrier didn't disclose its profit status in the report. Banglalink declined The Daily Star's obtain comments on the financial numbers provided in the report.

Banglalink saw a decline in voice calls and active customers through the quarter as the overall shutdown ate up people's disposable income.

However, its data revenue posted an enormous growth as Banglalink's investments in accumulating its 4G capacity and focus on selected digital services came in handy, as per the report. The carrier logged in Tk 293.65 crore as data revenue for the quarter.

"Given lockdown restrictions on customer movement before end of May and continued health safety concerns, Banglalink actively promoted the utilization of digital channels to facilitate top-ups, account management and the adoption of additional services," reads the report.

As a result of lockdown the carrier also reduced its capital investment and operational expenditure.

Its average earning per user atlanta divorce attorneys month declined to Tk 110 during the quarter from Tk 113 the prior quarter.

Another significant incident of this quarter for the operator was an extension of the maturity of its $300 million syndicated loan by yet another two years to 2022 since it had matured in April 2020.

VEON Holdings also purchased the $300 million facility from a syndicate of international lenders and repaid $100 million of the outstanding amount of VEON's Revolving Credit Facility, reads the report.

Availing this loan the then second carrier of the market made a substantial amount of investment expanding their network coverage.

The carrier also has invested plenty of money for purchasing additional spectrum in February 2018 and committed to 4G services.

The front-loading of network investments was to support 4G expansion. Towards the end of June Banglalink's 3G network population coverage approximately reached 74 per cent while 4G population coverage was 52 per cent.

The operator's earnings before interest, taxes, depreciation and amortisation (EBITDA) also declined both in quarter on quarter and year on year comparison.