Bangladesh still among top sourcing destinations

Bangladesh remains one of the top sourcing destinations after China for international clothing retailers and brands even through the coronavirus pandemic as a result of its competitive prices, according to a fresh report by leading supply chain compliance solutions provider QIMA.

After Vietnam, India and Bangladesh, alternative sourcing options of choice remain largely countries in Asia, including Taiwan, which enjoyed overwhelming preference as a sourcing market among US-based respondents.

The survey named "Evolution of Sourcing in 2020" was conducted in July 2020 by Hong Kong-based QIMA.

It is stated to be drawn on input from a lot more than 200 businesses around the world across a range of consumer product segments and built on previous QIMA research.

The report analyses the evolution of global sourcing in response to the ongoing Covid-19 pandemic, US-China trade tensions and other disruptions to global supply chains.

It says China is down, however, not out.

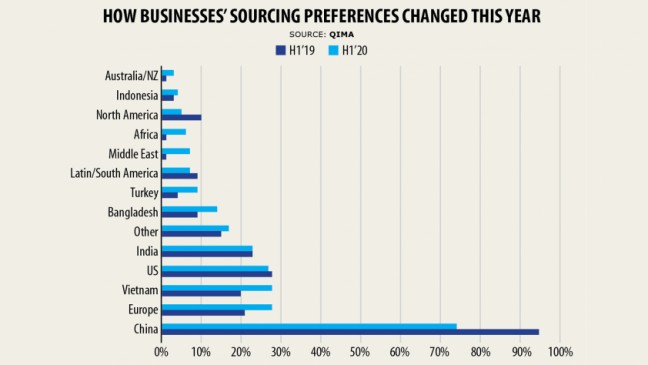

Although China still takes the crown for global sourcing, its dominance is noticeably less dramatic in comparison to previous years, especially in industries such as textile and apparel, where supplier portfolio diversification is a priority for some time now, the QIMA report said.

Nevertheless, 75 per cent of the respondents globally named China amongst their top three sourcing geographies, with 55 % reporting that Chinese suppliers accounted for over half the buying volumes in the first half of the entire year.

Vietnam continues using its upward trend, luring in Western buyers as an alternative to China.

Consistently ranking among China's regional competitors, Vietnam continues to reap the most advantages of the continued mass exodus of Western buyers from China, with 40 % of the EU respondents and almost as much US brands included Vietnam amongst their top sourcing regions.

That is in tune with Western brands not venturing too much from China.

The US and the EU brands are exploring sourcing options nearer to home but will near-shore instead of re-shore.

For US-based companies, sourcing destinations nearer to their home country continue steadily to grow steadily, with the popularity of Latin and SOUTH USA almost doubling weighed against last year.

Meanwhile, the EU brands are increasingly embracing Turkey as a near-shoring destination as the latter was named among the very best three sourcing regions by 30 % of EU respondents.

Diversification is on the top of the mind for global brands, but there are a few noticeable nuances between regions.

THE UNITED STATES brands are by far probably to diversify sourcing, with 95 % of US-based respondents reporting plans to the result, likely due to the pandemic and worsening geopolitical tensions between Washington and Beijing.

Alternatively, European buyers aren't as ready to walk away from China, with no more than half of the EU-based respondents reporting plans to get suppliers elsewhere.

While China remains a key sourcing region, named among the most notable three sourcing geographies by three-quarters of respondents globally, its dominance is less dramatic compared to the findings of QIMA sourcing surveys of previous years.

In 2018-2019, a lot more than 95 per cent of the respondents had listed China amongst their top 31 sourcing destinations.

The increasing share of the other in-demand sourcing regions in Asia, particularly Vietnam, India and Bangladesh, in addition to home regions, is another manner in which the long-term trend towards sourcing diversification is making itself known.

Among the "other" sourcing countries, Taiwan emerged an indisputable leader, reported by 6 % of respondents among their top three sourcing grounds, notably overwhelmingly among respondents headquartered in the US.

The other notable entries included, in descending order of popularity, Thailand, Cambodia, Malaysia, South Korea, South Africa, Japan and Pakistan.

Comparing the most recent survey data against the findings of QIMA sourcing surveys conducted in 2019 and 2018 offers a glimpse in to the evolution of the most notable three sourcing regions as indicated by the US and EU buyers.

Despite the continued need for China for buyers predicated on both sides of the Atlantic, its popularity has been inching downward, even among EU-based buyers, which were less damaged by the fallout of the US-China trade war recently.

Vietnam constantly remains among China's regional competition reaping the most advantages of the continued exodus of Western buyers from China.

Some 40 % of EU respondents and almost as much US-based types included Vietnam amongst their top sourcing regions.

Re-shoring and near-shoring have remained on the rise for US-based companies, with the growing popularity of the house region, and increased sourcing from Latin and SOUTH USA.

In the rankings of top sourcing countries, the latter region almost doubled in popularity in the first half a year of 2020 when compared to same period in 2019.

Meanwhile, respondents headquartered in the EU usually do not appear to be stepping up full-fledged re-shoring but are increasingly turning to Turkey as a near-shoring destination.

Some 30 % of the EU respondents named Turkey among their top three sourcing regions.

While reliance on China has decreased across the board, it remains a top-priority sourcing region for promotional products while toy businesses were much more likely to view Chinese suppliers as important, compared to 2019.

Furthermore to Vietnam, traditionally a footwear powerhouse, brands and retailers continued to view Bangladesh as an important sourcing market for footwear.

Textile and apparel businesses have continued diversifying their supplier portfolio, with an ever-lowering reliance on China and a far more even distribution between overseas sourcing in Asia and near-shoring.

While near-shoring remains popular than re-shoring, textile and apparel companies were more likely to get from US and EU-based suppliers in 2020 in comparison to last year.

Outside of being truly a go-to sourcing market for textiles, India is increasingly seen as a crucial sourcing region by buyers from different industries.

"Work orders are returning gradually. The inflow of work orders is way better in August than in June and July," said Mohammad Abdus Salam, acting president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), over the telephone.

But most of the work orders are leftover orders of April and May when the retailers and brands cancelled the task orders, he said.

Salam, however, said it was difficult to pinpoint what would happen in the near future for the reason that rate of unemployment and inflation was increasing under western culture. "So we are cautiously optimistic," he said.

Between 1 and 22 August, garment export from Bangladesh increased 45.8 per cent year-on-year to $2.4 billion, according to data from BGMEA.