Baffling rise of Monno Jute's share price

Monno Jute Stafflers yesterday became the most valued stock on the Dhaka Stock Exchange, overtaking British American Tobacco Bangladesh Company in what can be viewed as a curious development for the premier bourse.

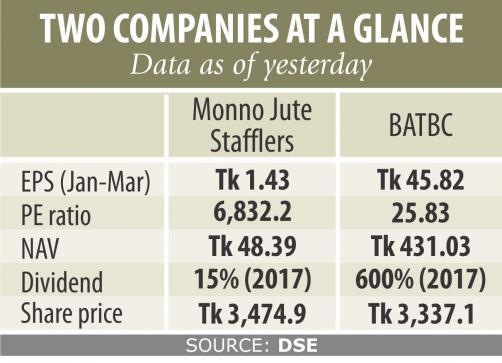

Earnings per share (EPS), often touted as one of the most important metrics in assessing a company's profitability, of BATBC stood at Tk 45.82 in the first quarter of 2018. In contrast, Monno Jute's EPS was Tk 1.43.

BATBC declared 600 percent dividend in 2017, whereas Monno Jute Stafflers announced a 15 percent dividend for its shareholders.

The price-earnings ratio, which gives an idea of the value of a company, also does not explain Monno Jute stock's turn of fortune.

A low P/E indicates either a company may currently be undervalued or that the company is doing exceptionally well relative to its past trends.

If the P/E is high, it warns of an overpriced stock. It means the stock's price is much higher than its actual growth potential, so the stock is more liable to crash drastically unless the company logs higher growth in profit. BATBC's P/E is 25.83 and Monno's 6,832.2.

In short, the fundamentals of Monno Jute's are far behind BATBC's and yet the former has dethroned the cigarette manufcaturer as the top valued stock of the premier bourse.

In the past five months, Monno Jute's share price soared five times to reach Tk 3,474.90 yesterday. Yesterday, BATBC's share price stood at Tk 3,337.1.

“Such a price hike of a low cap company within 5-6 months is nothing but a speculative hike as there is no news about its business expansion,” said Md Moniruzzaman, managing director of IDLC Investments.

The only additional news of Monno Jute is that it plans to increase its authorised capital to Tk 100 crore from Tk 1 crore.

The share price of this company cannot jump at this speed with this news only, he added. “Some are gambling with the low-cap companies and it is easy to play with these stocks,” said Abu Ahmed, former chairman of the economics department of Dhaka University and a stockmarket analyst.

The punters target these companies and then their share prices fluctuate abnormally, he said, while advising investors to think twice before parking their funds in low-cap companies.

On many days last month the worst performing companies became the top gainers and the demand for their stock was so high that trading had to be halted as there were a shortage of sellers, DSE data shows.

The securities regulator formed an enquiry committee to investigate the unusual and suspicious price hike of Monno Jute Stafflers last month.

This also could not stop the price hike of Monno Jute Stafflers.

The authority of Monno Jute Stafflers itself conveyed many times through the DSE that there is no reason for the unusual price hike of this share.

And yet, nothing could stop the investors from pouring their money into the stock.