Atlas sinking deeper into losses

Atlas Bangladesh, a motorcycle assembler and distributer, has been sinking deeper into losses ever since fiscal 2015-16 when its agreement with Hero Honda found an end.

This fall of that which was once a blue-chip stock has raised questions among investors about the firm's sustainability.

Following the deal expired, Atlas tried to retail Zongshen bikes but the Chinese brand failed to make a indicate in the country's burgeoning two-wheeler market.

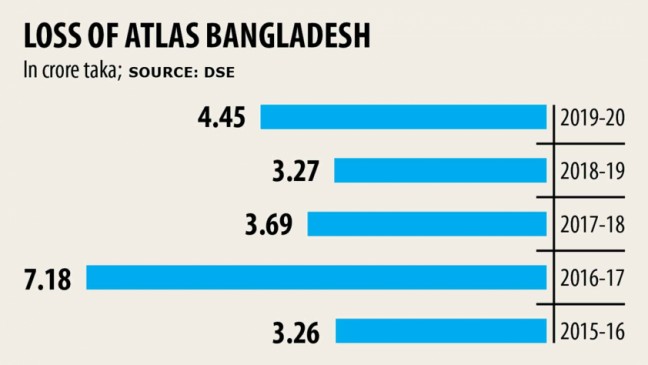

Therefore, the state-go company's accumulated losses stood at Tk 21.88 crore in 2019-20. This even prompted the business's auditor to improve concerns of "materials uncertainty on its heading concern due to five consecutive years of loss".

Going concern is an accounting term that pertains to whether a business entity has the information to continue functions in the future.

The issue of materials uncertainty in this regard for Atlas Bangladesh was posted on the Dhaka STOCK MARKET (DSE) website on Tuesday.

"Our company's profits began to fall when our agreement with Hero Honda ended, that was soon after Hero and Honda split up," explained Sanjay Kumar Datta, firm secretary to Atlas Bangladesh.

In 2013, The Honda Motor Organization of Japan announced that it ended its JV with India's Hero Group.

It was then that Hero joined hands with a local automobile company, Nitol-Niloy, while Honda started directly advertising its products found in Bangladesh.

Stated with the DSE in 1988, Atlas has a paid-up capital of Tk 33 crore.

In fiscal 2019-20, the business reported losses of Tk 4.45 crore, which was 36 per cent greater than that the year before, when it was Tk 3.27 crore.

Atlas' per talk about net operating cash-stream stood at Tk 1.44 in the negative at the end of last year.

After its handle Hero Honda expired, Atlas inked a two-year agreement with the Chongqing Zongshen Group in 2016 to import, assemble and market their motorcycles, Datta explained. The Chinese organization was among the leading two-wheeler corporations in China.

"In the primary two-3 years, we sold around 6,000 bikes of the brand. Even so, this brand failed to attract consumers further because of turning up of complaints from customers," Datta said.

However, the company received numerous problems and didn't win the hearts of Bangladeshi customers, leading to an automatic drop in revenue, he added.

Atlas also formed a great contract with India's TVS Electric motor Company in 2018 in order to procure the products needed from TVS Car Bangladesh to assemble and supply motorcycles to certain federal government institutions.

"But since this just we can sell the merchandise to government office buildings, we are trying to find new business," Datta added.

The government holds a 51 % stake in Atlas Bangladesh while institutional investors hold 16.94 % and general investors have 32.06 %.

"It really is disappointing for shareholders to see that what was once the second largest player in the neighborhood motorcycle market is now struggling to survive," said Hakim Ali, a share investor.

He said the business's management should try to find new business opportunities since consumers still trust the state-run entity.

The company's stocks closed at an unchanged Tk 109.40 yesterday at the DSE.