Asia-Pacific apparel sales to grow slightly in 2019

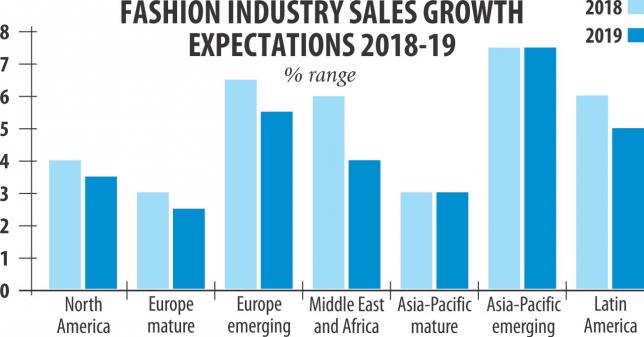

Sales of apparel items in emerging Asia-Pacific countries will continue to grow slightly in 2019 while it will decline in other major regions, including Europe, Middle East and Africa and Latin America.

Globally trusted research firm McKinsey & Company disclosed the information in a report—The State of Fashion 2019: A year of awakening—after surveying over 275 global fashion executives, alongside interviewing thought leaders and pioneers.

McKinsey and Company published the report in November last year in partnership with the Business of Fashion (BoF), which explores the industry's fragmented, complex ecosystem.

The number of global fashion executives surveyed for the latest report was nearly 30 percent more than that of the previous year.

“It is true that Asian markets like India, China and Japan are big for Bangladesh as our shipment to those has been growing every year,” said Siddiqur Rahman, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Garment shipments from Bangladesh—the second largest exporter worldwide after China—to those three are rising by the day thanks to competitive prices offered by the country and spiralling production cost in China.

Bangladesh's strength in formal garment production and higher economic growth in populous Asian countries have also helped such shipments to increase, which could hardly reach a few million dollars only five years ago, experts said.

Garment export to the three markets grew by nearly $1.5 billion which was only a few hundred million even five years ago.

Japan is the only nation where Bangladesh exported goods worth more than $1 billion apart from its traditional markets -- the European Union, the US and Canada.

Among the major fashion items, sportswear would continue to be the major items in 2019 while sales of other items like apparel and handbags will continue at the same level as of last year.

Sales of other fashion items like footwear, jewellery, watches and other accessories will decline in 2019.

“All this comes against a backdrop of the fashion industry having turned a corner in 2018, with increased growth justifying the optimism expressed in last year's global fashion survey,” said the report.

“The caution in the economic outlook is also reflected in the BoF–McKinsey State of Fashion Survey, with 42 percent of respondents expecting conditions to become worse in 2019,” it said.

“Polarisation continues to be a stark reality in fashion: fully 97 percent of economic profits for the whole industry are earned by just 20 companies, most of them in the luxury segment,” the survey said.

Notably, the top 20 group of companies have remained stable over time, the report said, adding that 12 of the top 20 have been a member of the group for the last decade.

“Long-term leaders include, among others, Inditex, LVMH, and Nike, which have more than doubled their economic profit over the past 10 years,” according to the survey.

“According to our estimates, each racked up more than $2 billion in economic profit in 2017,” it said.

New markets, new technologies and shifting consumer needs present opportunities but also risks, the report added.

“We predict that 2019 will be a year shaped by consumer shifts linked to technology, social causes, and trust issues, alongside the potential disruption from geopolitical and macroeconomic events,” it said.

“Only those brands that accurately reflect the Zeitgeist or have the courage to 'self-disrupt' will emerge as winners,” the survey also found.