After a trying year, cement manufacturers bracing for slower recovery

With the year going to come to a close, the cement sector finally experienced some relief from the ongoing pandemic because of increased consumption alongside fresh investments.

Makers of the key construction material have been around in a tight location since the Covid-19 outbreak commenced as almost all major development assignments in the united states, both public and personal, were halted for a long period.

"The cement sector was able to survive despite the fact that the suppliers sat idle throughout April-September," Mohammed Amirul Haque, managing director of Premier Cement, told The Daily Superstar.

But now, there are several projects to work on, including mega jobs like the Karnaphuli Tunnel.

"We got some orders from the structure sector and our factory is certainly running at full ability," he said, adding that Premier Cement items cement to at least 77 government projects.

According to the managing director, there is no need to waste time about counting losses amid the pandemic seeing that no person knows when the problem will go back to normalcy.

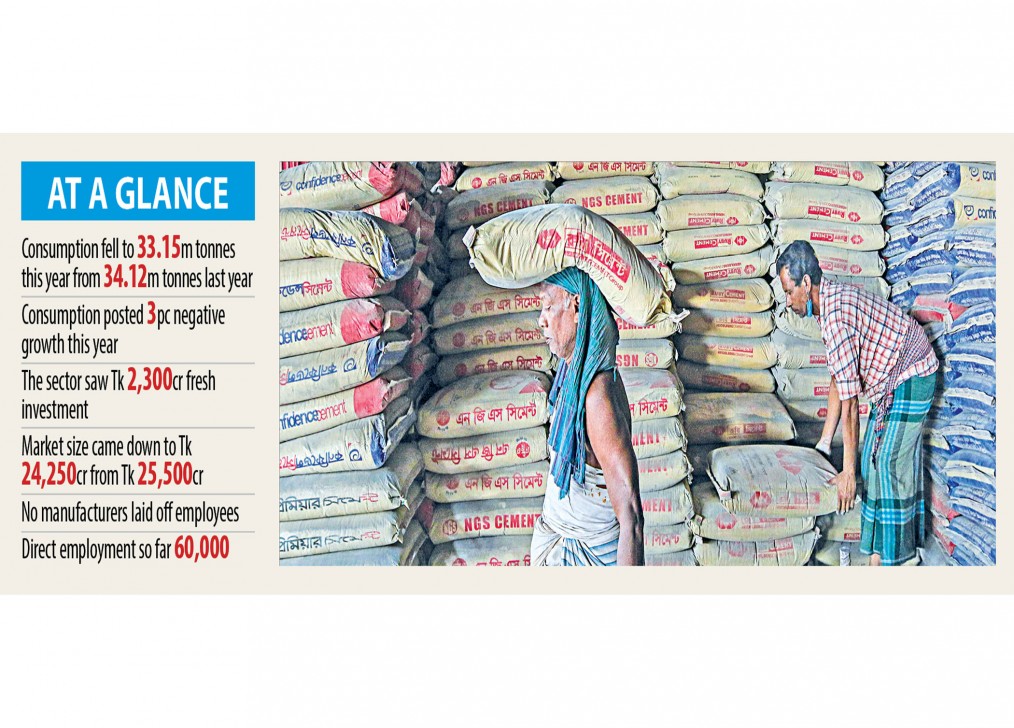

Despite these turbulent circumstances though, investment in the cement sector didn't cease as around Tk 2,300 crore was spent on the industry over the past few months.

Of the amount, Premier Cement spent Tk 800 crore to determine a new unit in Narayanganj and another for Tk 500 crore in Chattogram. Nevertheless, the new units are yet to begin development despite having been ready since March.

"We're able to not start development within the stipulated time due to the absence of some technical professionals and employees of China and Denmark," Haque said.

Now, the cement maker expects to commence commercial production subsequent March or April.

Bangladesh's cement sector offers 43 per cent overcapacity and want others hometown Bashundhara Group also had unused capacity. So the group gone beyond borders for opportunities and finally observed it in Northeast India.

The local professional conglomerate is trying to seize the export market of the region through a Tk 1,000 crore investment geared towards doubling its manufacturing capacity through the establishment of a third production unit.

To materialise the program, Bashundhara is mobilising Tk 700 crore from banks.

Bank Asia is acting as the lead arranger of this syndicated term mortgage loan for Bashundhara Industrial Complex while the other participants are actually: Dhaka Bank, First Secureness Islami Bank, Pubali Bank, Social Islami Lender and United Commercial Bank.

Through this growth, Bashundhara's daily development capacity will reach 25,000 tonnes.

Khandoker Kingshuk Hossain, chief marketing officer of Bashundhara Cement, told The Daily Superstar that the sector will shrink by about 3 % this season due lower consumption in comparison to last year.

The cement sector's promote size reached 34.12 million tonnes in 2019 and it could drop to around 33.15 million tonnes this season.

"Business will not run equally yearly as there are ups and downs. But this season was different as a result of Covid-19 fallout," Hossain said.

The sector suffered an unprecedented collapse popular between April-May, when the federal government declared a nationwide shutdown to curb the pass on of Covid-19.

Sales started to bounce back to pre-pandemic amounts from June-July.

"But it will still remember to go back to full capacity simply because both government and personal development works are however to get momentum," explained Mohammad Shahidullah, first vice-president of the Bangladesh Cement Producers Association (BCMA).

Regarding the entire situation, he said that apart from the coronavirus pandemic, repeated flooding provides wreaked havoc about the country's construction tasks and the cement sector is normally bearing the brunt.

Besides, manufacturers were unable to accumulate their dues from dealers and contractors because they too had been devastated by the pandemic, added Shahidullah, also managing director of Metrocem Cement.

Cement manufacturers often found themselves found in a good spot even prior to the pandemic began, when overproduction resulted in unhealthy competition.

Asadul Haque Sufiyan, chief operating officer of Bengal Cement, recently said that as a result of the pandemic, cement consumption will likely to come down to 7 % this season from the 12-15 % standard growth it clocked for the last few years.

Sales increased slightly due to mid-income people and expatriates started purchasing the key construction material however the government's buy for development jobs is yet to reach expected levels, he added.

The sector's confidence continues to be intact largely because of steadily growing demand in a country where the per capita cement consumption is quite low.

There are 37 active cement factories in Bangladesh and a lot more than Tk 30,000 crore has been invested in the industry.

Manufacturers have a good combined annual production potential of 58 million tonnes against an area demand of 33 million tonnes.

In the 1990s, Bangladesh used to meet up 95 % of its total demand for cement through import but the requirement is currently met totally by the neighborhood industry, where gross annual sales reach $3 billion, based on the BCMA.

Of the consumption, individuals take into account 25 per cent, property companies and developers 30 per cent and the public sector 45 %.

The industry employs 60,000 persons directly and another one million indirectly.