ACI returns to profit on higher sales of hygiene products

As the coronavirus pandemic continues to hammer financial activities, Advanced Chemical Industries (ACI) has managed the crisis than most others since it posted an elevated sale of hygiene items.

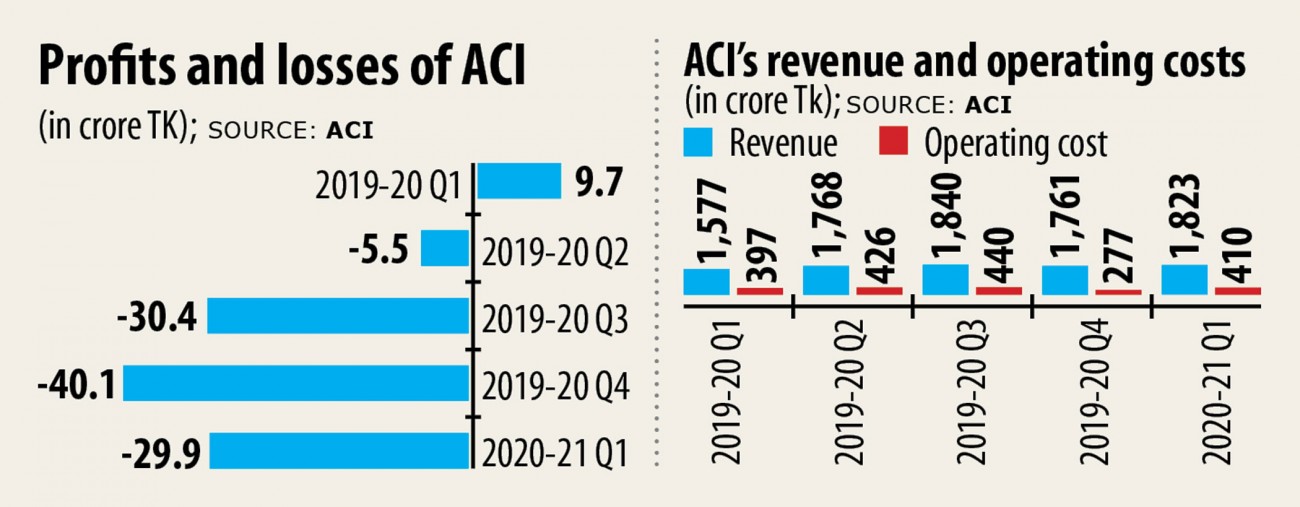

And although the pandemic has taken a toll on the operating costs, the group's consolidated profits stood at Tk 9.7 crore in the first quarter of the fiscal.

This is an enormous feat for the company as it was Tk 29.9 crore in debt through the same quarter this past year.

"Our profits rose because of higher sales, manipulated operating costs and lower finance costs," said Pradip Kar Chowdhury, chief financial officer of ACI.

ACI's sales grew 16 per cent to Tk 1,823 crore in the July-September quarter when compared to same period this past year. Operating expenses were up 3 per cent to Tk 410 crore.

Net finance cost declined 11.57 % year-on-year to Tk 92.33 crore, the business's financial report shows.

"The sales of pandemic-related hygiene products grew in the last few months. This boosted our brand value," Chowdhury said.

ACI Consumer Brands sells items in the categories of toiletries, home care, hygiene, electrical, electronics, mobile, salt, flour, foods, rice, tea, edible oil and paints.

ACI Agribusinesses may be the major integrator in Bangladesh in agriculture, livestock, fisheries, farm mechanisation, infrastructure development services and motorcycles, while ACI Retail Chain may be the most significant network of super-shops operating through 129 Shwapno outlets.

It has a occurrence in the pharmaceuticals segment. The company's hygiene products range from sanitizers at hand wash and soaps.

The sales of ACI's Consumer Brands surged 68.85 % to Tk 209.23 crore in the first quarter.

The pharmaceutical segment saw a rise in sales to Tk 314 crore, up from Tk 299 crore in the first quarter in 2019.

ACI' shares rose 3.81 % to Tk 264 yesterday on the Dhaka STOCK MARKET after news broke that the conglomerate had returned to profits in the first quarter.

"We were able to keep our employees motivated which positively impacted our company during the pandemic," said a top official of ACI preferring anonymity.

"No one lost jobs through the pandemic. Moreover, the income of the employees was reviewed positively, which eventually motivated them to work harder through the entire tough period."

The business's variable costs on the advertisement and promotional activities were also slashed, he added.

Net operating cash flow per share was Tk 30.17 in the negative in the first quarter. It had been Tk 7.24 in red during the same period in 2019.

ACI's consolidated net operating cashflow was also in the negative due to high consumption of working capital to build up inventory and focus on increased demands, the business said in a disclosure published on the Dhaka STOCK MARKET (DSE) website yesterday.

It declared 80 per cent cash and 10 % stock dividends for the entire year that ended on June 30, 2020, despite incurring losses of Tk 105 crore in the entire year. Losing stood at Tk 74 crore a year ago.

The dividends were recommended out of accumulated profit, the company said in its statement.

It had been not recommended from the administrative centre reserve, revaluation reserve, unrealised gain or profit earned prior to the company's incorporation and through reducing paid-up capital, anything that would turn post-dividend retained earnings negative or debit balance, ACI added.

In fiscal 2019-20, its consolidated earnings per share were Tk 18.45 in the negative against Tk 13.51 in the negative for the same period the prior year.

ACI's total revenue was about Tk 6,974 crore within the last fiscal year, up from Tk 6,314 crore this past year.

The company has a reserve and surplus of Tk 874 crore, according to DSE data.

"It's a good sign that a big market capital-based company like ACI has returned to profits amid the pandemic," said Abdul Mannan, a stock investor.

ACI's market capitalisation was Tk 1,458 crore by yesterday.

Because the company had incurred losses going back few quarters, mainly due to higher finance costs, ACI should concentrate on getting equity investment to expand and repay loans early, the investor said.

"We want to see good companies like ACI make money because it boosts the confidence of investors," he added.