Accept deferred repayments to benefit equally nations: FBCCI to India

The Federation of Bangladesh Chambers of Commerce and Sector (FBCCI), the country's apex trade body, on Mon demanded that India accept deferred payments as high as 240 times for more value addition and jobs in the bilateral supply chain.

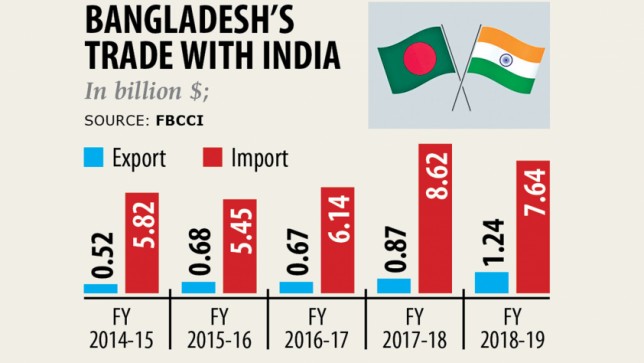

India is currently the second largest import supply for Bangladesh after China. Indian businesses supply most the industrial recycleables required by Bangladesh with an gross annual export value around $8 billion through formal channels.

Western retailers and brands are deferring payments to local manufacturers and exporters as a result of Covid-19 crisis therefore, allowing the same for the latter while maintaining healthier supply chains may stimulate businesses, protect existing jobs and create latest types for both nations.

Job creation and investments through Bangladesh-India joint ventures are actually is best way to profit both nations and stimulate the market amidst the coronavirus fallout, said FBCCI President Sheikh Fazle Fahim.

Fahim made these comments while addressing a webinar themed, 'India-Bangladesh Trade and Investment: Stakeholders Interaction', jointly organised by the Federation of Indian Chambers of Commerce and Industries (FICCI) and the Indian high commission in Bangladesh.

Presently, bilateral trade with India stands at about $9 billion.

"And as a result of Covid-19 realities…joint investments that are part of the value chain for services and products, of which recycleables happen to be from India, finished things are in Bangladesh, used in production in Bangladesh and re-exported to India and beyond, is a technique that I think both nations would reap the benefits of," Fahim said.

Exploring opportunities in light engineering, a worth chain initiative with recycleables from India and creation in Bangladesh, will become another complimentary initiative in an extended list of bilateral cooperation, he added.

Revising the provision in deferred payments will assist in raising exports of backward linkage products out of India to Bangladesh and exports to India and outside of through bilateral value chain initiatives, targeted to global markets, said the FBCCI President.

Fahim also requested Indian stakeholders to consider extending deferred letter of credit payment facilities from Indian banks for 240 days.

The expanded deferred payments should increase procurement volumes for enterprises presently engaged in diverse countries apart from India, the FBCCI president also said. High import tasks, specifically on passenger and professional vehicles, come in just how of accelerating bilateral trade, brought up Manoj Chugh, president (group open public affairs) of Mahindra & Mahindra, as per an FBCCI affirmation yesterday.

"Suitable retail finance needs to be enabled for such goods in the Bangladesh market," Chug said.

On his stage on diversification of routes to ease the movements of goods to promote investment and trade, Fahim said they needed to think a little beyond the box as the conventions have already been such with regards to cost effectiveness.

"Waterways is the best option. Then there is the railway," he said.

"There are pushes towards exploring and as quickly as possible executing these routes regarding passenger cars or almost any goods and providers that involves Bangladesh from India or the merchandise that would go to India," the statement reading.

Riva Ganguly Das, Indian great commissioner to Bangladesh, echoed exactly like keynote speaker.

"Indian railway and Bangladesh railway are working together which shows how committed they happen to be to provide even logistics," she said.

India is focused on take on regional cooperation forward, she said while praising several other speakers' tips on remote deduction of duty on travellers and commercial vehicles.

Dilip Chenoy, secretary basic of the FICCI, and Manish Singhal, FICCI deputy secretary standard, presided over the program.

Abdul Matlub Ahmad, president of the India-Bangladesh Chamber of Commerce and Industry, Venkat Nageswar, deputy managing director of the Status Bank of India, and Ashok Anantharaman, director (foreign) of CNH International, also participated on the webinar.