96pc bikes made locally

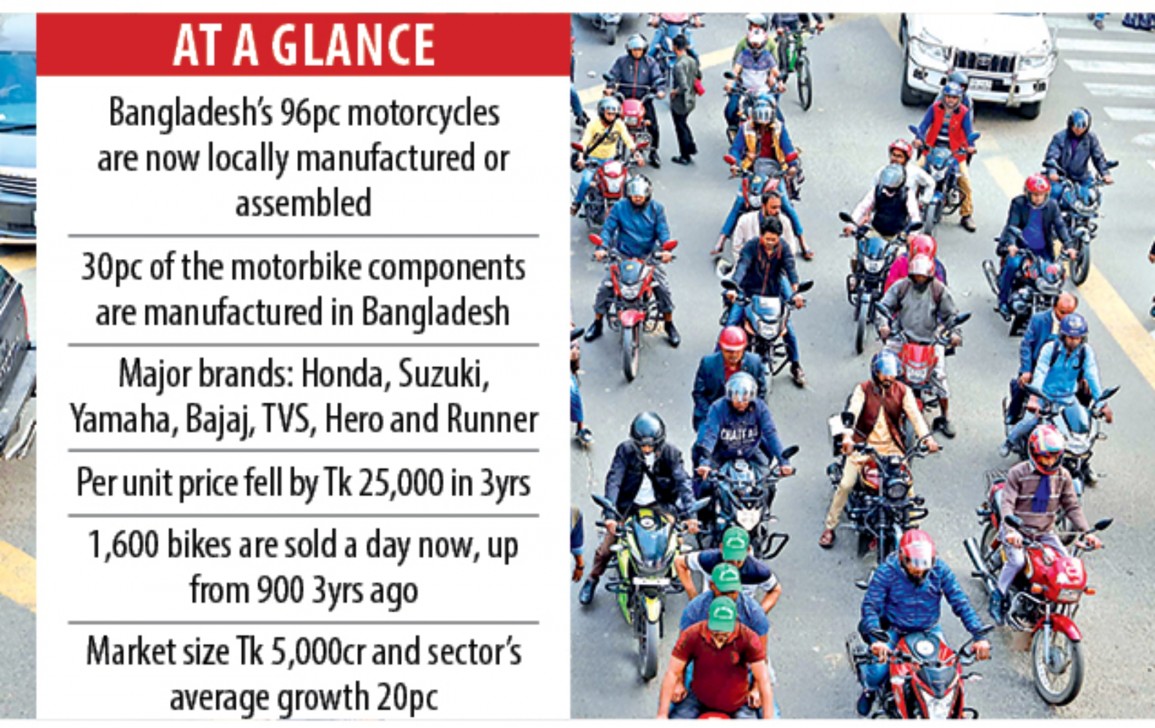

Just two years ago, Bangladesh was dependent on imports to meet 95 percent of its demand for motorbikes. But the situation has completely reversed: Today, around 96 percent of the two-wheelers plying on the roads are either locally manufactured or assembled, industry people said.

Seven firms – Japanese brands Honda, Suzuki, Yamaha, India’s Bajaj, TVS and Hero, and Runner Automobiles of Bangladesh – have made the country almost self-sufficient in motorbike manufacturing or assembly in the fast growing market.

Bangladesh’s journey from a motorbike importer to a local assembler and manufacturer hasn’t only saved valuable foreign currencies needed to meet import bills. It also created thousands of jobs.

Besides, the price of a bike has reduced by Tk 15,000 to Tk 25,000 per unit, according to Biplob Kumar Roy, chief executive officer of TVS Auto Bangladesh Ltd (TVS ABL).

The turnaround came in 2016-17 when the duty on import of completely knocked down (CKD) units of the two-wheelers was slashed by 25 percentage points to 20 percent to encourage local assembly and subsequent manufacturing.

The emergence of ride-sharing has given further impetus to the sector.

Operators now predict that the market would grow many folds in the next two-three years because of rising incomes, steady growth of economy and favourable policy and tariff structure.

Around 1,600 units of motorbikes are sold every day in the country, nearly doubling from 900 units in 2016, according to market players. Last year, about 480,000 bikes were sold, up from 387,000 units in 2017 and 270,000 units in 2016.

Assuming the price of a motorbike is Tk 1 lakh on an average, the total sales figure would be around Tk 5,000 crore a year, almost equivalent to the market size of four-wheelers.

Runner Automobiles showed the courage to set up the country’s first automobile manufacturing plant in 2007 at Bhaluka in Mymensingh. The bike manufacturing began in 2010.

Hafizur Rahman Khan, chairman of Runner Automobiles and also the president of the Bangladesh Motorcycle Manufacturers and Exporters Association, said the plant is manufacturing bikes in 14 models.

Runner Automobiles makes almost all components needed to produce a bike except for some basic parts of the engine, he said, emphasising on developing backward linkage, which is vital to expand capacity.

TVS ABL introduced TVS bike in Bangladesh in 2010 and within seven years the company became the second-largest seller of two-wheelers in the country, with around 25 percent market share.

The company set up its manufacturing and CKD plant in 2017 with a capacity of 500 units per shift, which comprises eight hours. It started the manufacturing process last year and now churns out seven models and assembles three more models for the Bangladesh market, Roy said.

However, they can’t stake a claim to the “Made in Bangladesh” statement because of the absence of a backward linkage policy, he said.

Bajaj is the market leader with 40 percent share. It sold around 2.25 lakh units in 2018. It manufactures 12,000 units per day at its Zirani factory in Savar.

Dileep Banerjee, CEO of Uttara Motors, the sole distributor of Bajaj motorbikes, said Bajaj sold more than 20 lakh units in the past 40 years.

He said most of the models of Bajaj are available in Bangladesh either through manufacturing or assembly and the quality is the same like it is in India.

However, Banerjee said the company is still far away from manufacturing all components in Bangladesh as there is no policy for local vendors.

Hero, one of the fastest growing brands in Bangladesh, established an assembly plant four years ago under a joint venture with Nitol-Niloy Group. The facility was upgraded to a manufacturing unit in 2018.

The plant manufactures 125,000 units per year although it has capacity to manufacture more than 200,000 units. Hero makes 22 components, including chassis, rims and chains, which are needed to make a bike in the country, said Abdul Matlub Ahmad, chairman of Nitol-Niloy Group. Japan automobile giant Honda rolled out a motorcycle manufacturing plant in November last year, in what can be viewed as a watershed moment for the country’s industrial capabilities.

The plant was set up at Tk 230 crore on 25 acres of land in the Abdul Monem Economic Zone in Munshiganj.

Bangladesh Honda Private Ltd, a joint venture between Honda and the state-owned Bangladesh Steel & Engineering Corporation, manufactures seven models of Honda motorcycles.

Currently, the plant has an annual production capacity of 100,000 units. By 2021, the capacity will expand to 200,000 units, said Shah Muhammad Ashequr Rahman, head of finance and commercial of Bangladesh Honda Private Ltd.