10pc tax on all savings tools

The higher tax on profits from national savings instruments from this fiscal year will be applied on both new and old certificates, in a blow to the fixed income population.

In the budget for fiscal 2019-20, the government imposed a 5 percent tax at source on the profit on savings certificate along with the previous five percent.

So, the profit earners from saving instruments will now have to count 10 percent tax in total.

Other than savers, the members of parliament had also requested the government to withdraw the 5 percent tax on profits from savings instruments.

But the government resisted as it looks to reduce its heavy dependency on savings instruments to fund its budget as well as channel deposits towards banks, which are going through an extended liquidity crisis.

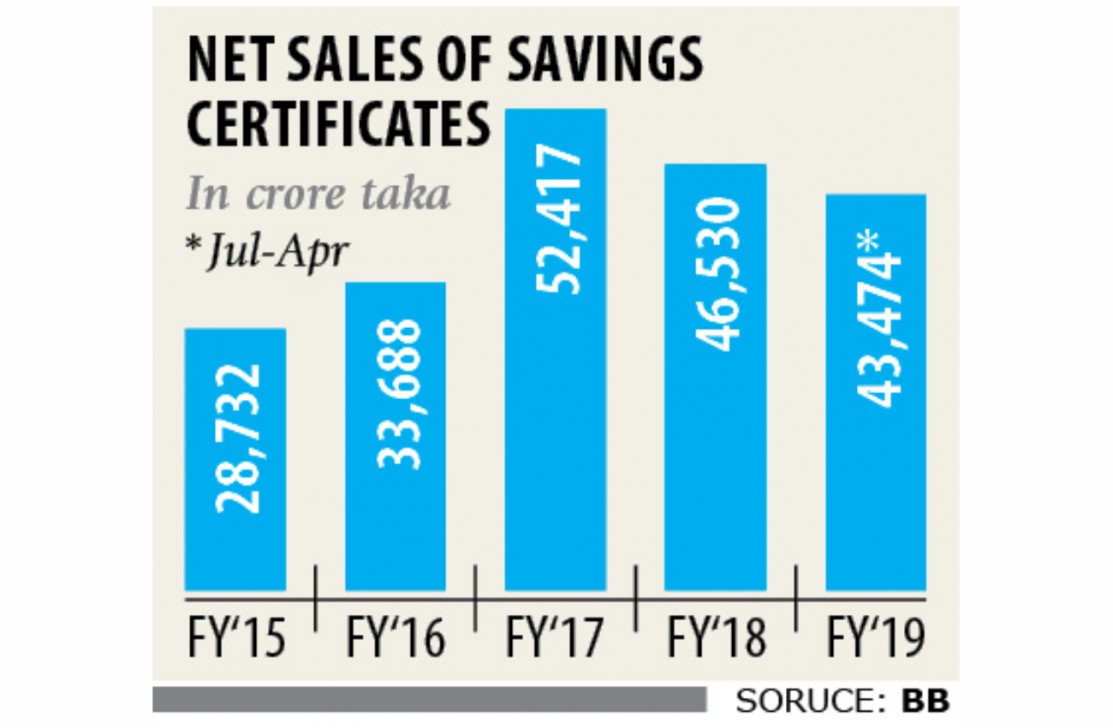

At the beginning of fiscal 2018-19, the government had targeted to borrow Tk 26,000 crore from savings instruments but it ended up revising the target up to Tk 45,000 crore.

Every year, the government has to spend a big amount to service its borrowing from savings certificates, said a finance ministry official.

For instance, the government had to spend Tk 45,278 crore as interest payment on its domestic borrowing last fiscal year, the majority of which was for savings instruments.

This fiscal year, the government allocated Tk 52,797 crore as interest payment on its domestic borrowing.

The high interest rate on saving certificates allured not only the fixed income group or pensioners but also many rich people, who tend to buy them in bulk, and institutional investors.

For example, wealth statements submitted by many candidates in the national election showed that some of them and their dependents owned savings instruments and postal savings certificates amounting to more than Tk 48 crore each, which is more than the ceiling of Tk 60 lakh.

The government has introduced the ‘national savings scheme online management system’ all over the country for checking the loopholes in the system that allows one person to own more than one savings certificates, the finance ministry official said.

So, new investors will have to buy the savings certificates online from now onwards.

But, it will take at least two years to transfer the record of existing savings certificates online, he said. The central bank also published a notice yesterday that called for checking the misuse of savings certificates by institutional investors.